On the surface, US industrial production – the most important component of any manufacturing recovery, or alternatively recession – is solid. In August, Industrial Production surged by 0.6% which was the biggest sequential increase since November. Of course, as we have shown, the only reason industrial production is strong is because of subprime debt-funded auto purchases which have sent new motor vehicle production soaring in recent months, but as long as the recovery narrative is intact, what’s another “little” auto subprime bubble: surely the Fed can make it disappear in “15 minutes.”

On the other hand, there is a huge flashing red light when looking at the entire industrial lifecycle of US manufactured products: while production is brisk, end demand in the form of completed sales, is crashing.

And this is where the alarm buzzer for the US economy goes off, because while industrial production does suggest the recovery is stable, the ratio of US inventory to sales has tumbled to levels indicative of recession, which also means that while US factories are humming, their output is accumulating in warehouses, overflowing parking lots and storage facilities.

So to answer the question: yes, the US recession is hiding just under the “question mark” at the unexplained and perplexing divergence between industrial production, and actual end sales…

Click on picture to enlarge

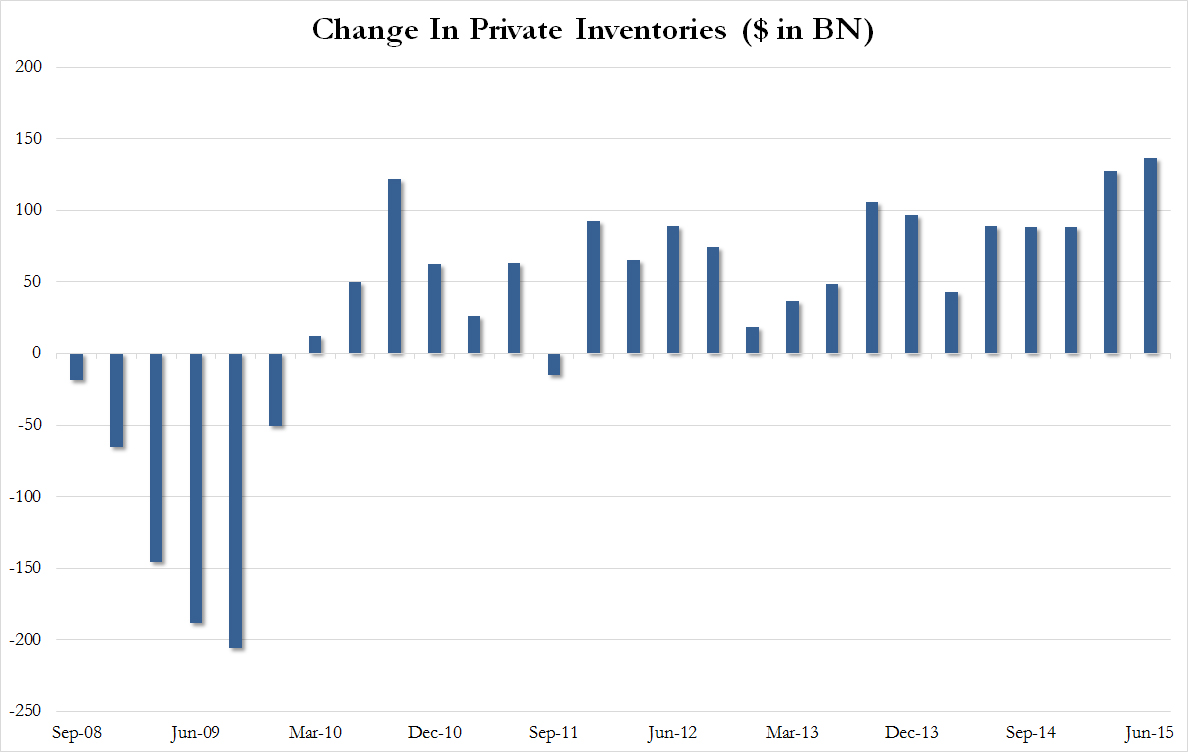

…. all of which result in a record inventory stockpiling which as we showed before, is what recently boosted Q2 GDP to an unsustainable 3.7% growth rate.

Click on picture to enlarge

What happens when the inventory liquidation finally arrives as end demand fails to materialize? One word: recession.

And just to preempt the next question: how much longer can the can be kicked, here is Bank of America’s explanation:

During the past four US manufacturing recessions (ex-GFC), global EPS has declined by 16% on average peak-to-trough. Since current EPS is already down 8.5% since mid-2014, this suggests another 8-9% downside in this worst-case scenario.

Leave A Comment