Fed meeting on Wednesday.

Trump didn’t do anything too crazy over the weekend (but Turkey did), so we haven’t got much to do while we wait for the Fed to officially raise rates 0.25%. Oil’s fall is calling a big stir in the news but it’s hardly news to us as we were shorting it all the way to our goal at $48.75 and now, at $48 (/CL), we’re more interested in finding a bottom while everyone else begins to panic. So far, so wrong on Gasoline (/RB) and we’ve tried to play that long off the $1.60 line and now $1.58 but we’re sticking with them as refineries are rolling over to summer blends and production goes off-line.

And yes, by the way, the analysts you are seeing on TV and reading in the MSM all know that the refiners roll over every spring and that this week is always the peak of inventories (see chart above) but they are not giving you that information because it doesn’t fit the narrative of getting you to panic out of Gasoline ahead of the summer driving season (May) because the Wall Street Criminals these analysts work for want to buy into Gasoline for as little as possible and, to do that, they send out their lackeys to push your panic buttons.

Gasoline fell to $1.525 last March and stayed low into April but then topped out at $1.80 in may. 27.5 cents up on a Gasoline Futures Contract (/RB) at $420 per penny is a gain of $11,550 per contract, which is why we began buying at $1.60, though we’re happy to buy more if it gets cheaper – we just don’t want to miss the fun!

Speaking of fun, this chart from BAC/Merrill sums it up nicely for the human race – game over!

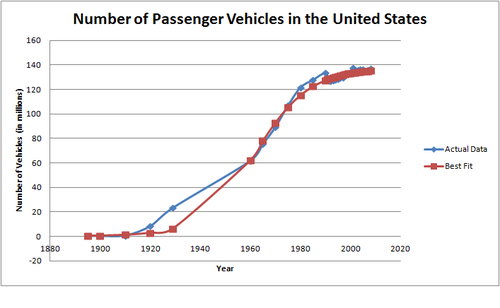

Now, you may look at those numbers and think 2.5M robots is not that many but, sadly, that’s because you don’t know how fast technology ramps up. Robots replace workers and save the buyer (who has access to capital) money over the course of their “lives” so we can expect more rapid adoption than say, Autos, which took about 25 years to catch on and then voom!

Leave A Comment