In my first energy economics textbook, ENERGY ECONOMICS: A MODERN INTRODUCTION (2000), the title of the chapter on natural gas was A Fuel of the Future: Natural Gas. The purpose of that chapter (and some of the remainder of the book) was to convince readers that when oil and coal were on the downward slopes of their cumulative production curves – i.e. annual output was declining –natural gas would still be going strong. My goal was to demonstrate some useful aspects of economics to students and others, and my arguments apparently made sense to many readers. Unfortunately, all of them no longer make sense to me.

In the book I often refer to as Energy Economics 101, David Goodstein – professor of thermodynamics at the California Institute of Technology – suggests that the beautiful natural gas future I had in mind, but did not specify in detail, is unlikely to last much past the middle of the present century, even though shale natural gas (and oil) have made a dramatic appearance in the United States (U.S.), and large shale reserves are to be found elsewhere.(This might also be the place to note that natural gas or oil ‘reserves’ are the amount of these resources that supposedly can be profitably extracted given current technological limitations.)

Professor Goodstein’s logic is quite clear, and similar to the hypothesis that I always offer students when discussing items like crude oil: even if the reserve-production ratio – (RESERVES/PRODUCTION) = (Q/q) –for natural gas in the U.S. is about 100 years, which is an estimate quoted by the President of the United States on a number of occasions, there are excellent reasons to doubt that the present annual output could be made available for an entire century.

Before looking at this and similar topics, a few commonplace items need to be mentioned. The CIA Fact-book tells me what I want to know about natural gas reserves, and can also tell you if you turn to their site. For instance, the leading countries where natural gas reserves are concerned are Russia, Iran, Qatar, the United States, Saudi Arabia, Turkistan, the United Arab Emirates, Venezuela, Nigeria and Algeria, in that order. Remember this when the conversation turns from football or fashion to energy, and do not ignore some of the oddball talk about the U.S. exporting large amounts of energy resources, even though at the present time that country is a significant importer ofnatural gas and oil.

The importing roster for natural gas runs as follows. Germany and Japan are at the top, followed by Italy, the U.K., South Korea, France, the U.S., Russia, Turkey, Spain, China, and a long list of less prominent importers. If you examine a list of natural gas exporters, you will note that many countries are both exporters and importers. Geography and price explain this phenomenon.

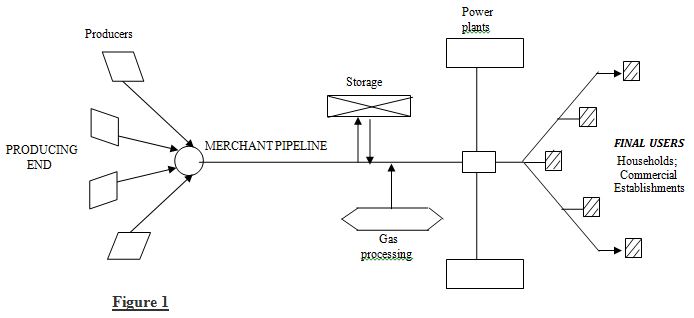

I have the impression that a number of subjects have not received the attention they deserve in the teaching of energy economics, but as I explained to students in my course on oil and natural gas economics at the Asian Institute of Technology (Bangkok, Thailand), certain things should be learned perfectly, and a few of those items are in this contribution. For instance, reproducing the following diagram is an exercise that students will encounter on many of my examinations.

Sadly, my skill with a computer goes no further than basics, because the block in the above diagram that says power plants should also indicate that that designation applies to the box of similar size directly below, and is intended to denote large consumers of natural gas (like power plants). At the producing end of this scheme the intention is to show gas from various ‘wells’ going into what are called (large) ‘merchant’ pipelines, and eventually – after perhaps some processing and storage – reaching large and small consumers. In addition it should be understood that there is a difference between the size of the merchant pipeline and smaller pipelines taking gas to homes and small businesses.

The exact nature of that difference is unknown to me, and I have never been sufficiently curious to alleviate this shortcoming, but such is not the case with the following diagram that deals with the gas transmission process. Here I can mention that most of my students at the Asian Institute of Technology were graduates in some branch of engineering, however a full comprehension of the next topic requires only some elementary economic theory, or the willingness to acquire a fraction of that background, especially the part outlined in the pages on production theory that you can find fairly early in a textbook on Economics 101.

Leave A Comment