Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level.

If there’s a country in the world which is really going to affect everyone else and which is vulnerable, it’s got to be China today. If there’s a country in the world which is really going to affect everyone else and which is vulnerable, it’s got to be China today.

The problem is, for Rogoff, a lot of debt which could at some point act as a further anchor as China attempts to restructure its economy from industry to the Chinese consumer and services. Such rebalancing is inherently risky, especially with so much debt supporting it.

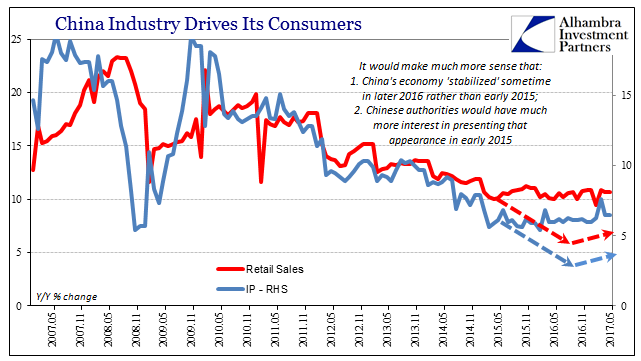

Again, I’m not sure Mr. Rogoff has been watching China all that closely. The government may claim that the economy is rebalancing, but so far there is little evidence at all it is actually doing so. Retail sales growth is today a third of the pace that used to be normal when China’s factories serviced the rest of the developed world. Industry is still at the heart of its economy, and most debt has been underwritten not for the coming Chinese consumer economy but instead in anticipation of going back to the rapid growth of its industrial past.

If there is any risk in China, it is that such debt is forced to be re-evaluated before the possible transformation is near enough complete (not getting much of a start would qualify). So long as Chinese investors and “hot money” holders believe it is legitimately plausible, then they might hold off on reassessing debt. China’s treasury market, however, this year indicates such processes might already be underway.

The big question is how long the system can maintain itself in such a stubborn state; where the consumer side fails to grow as anticipated for rebalancing. The less likely China’s economy is to hit that mark, the more likely debt begins to be reprocessed and ultimately repudiated at current prices. That’s not risk of China recession, it’s a transformational issue in the other (wrong) direction (permanent slowdown).

Leave A Comment