Last week we closed the books on May and tip-toed into the last month of the current quarter. With all the major market indices once again inching higher last week, 2Q 2017 to date returns now range between 2.6 and 3.2 percent for the Dow Jones Industrial Average and S&P 500, with the standout being the Nasdaq Composite Index at up 6.8 percent. The Nasdaq continues to be fueled by the model horsemen of the Connected Society and Asset-Lite Business investment themes: Amazon (AMZN), Facebook (FB), Apple (AAPL), Alphabet (GOOGL) and Microsoft (MSFT). With several of those stocks are now in overbought territory — yes we mean you Amazon, Microsoft and Alphabet — we have to question how much further the Nasdaq will climb in the near-term, especially as it too has entered overbought territory.

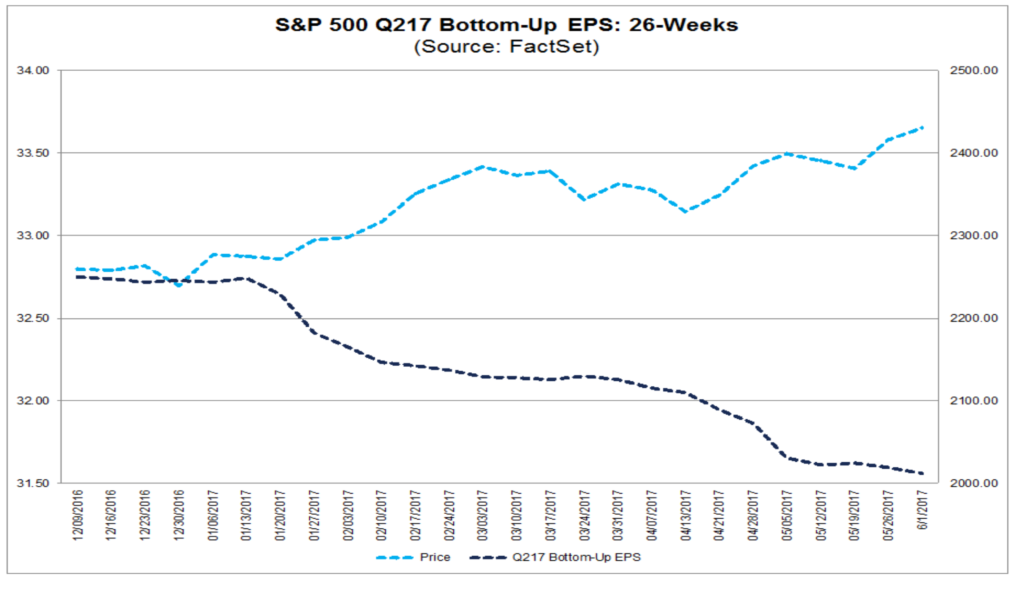

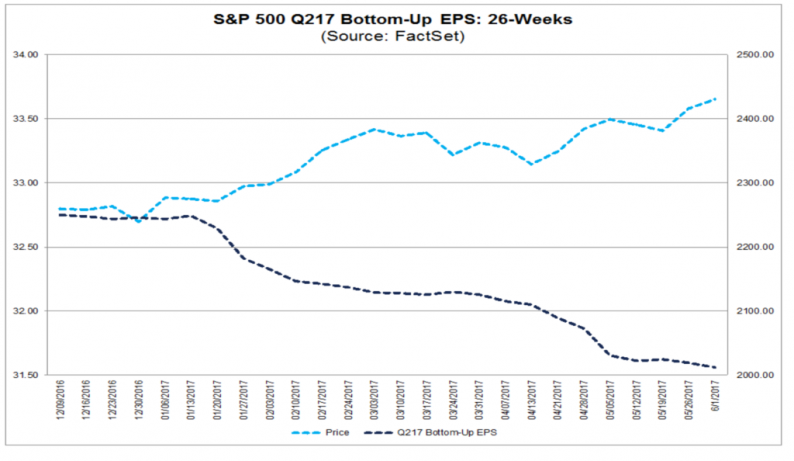

The S&P 500 is on the cusp of overbought territory as well. When that’s happened in the recent past that index has either traded sideways for several weeks — as we saw over the December 9, 2016 – January 23, 2017 period — or it has soon peaked and traded off as evidenced by the move in late February and the first half of March. Now for the sobering thought . . . this continued move higher quarter to date in the S&P 500 has come even though EPS expectations for the current quarter have been trimmed as have those for all of 2017. During the first two months of the current quarter, analysts lowered earnings estimates for the S&P 500 group of companies 1.7 percent to $31.58 from $32.13 during this period. With some modest tinkering to expectations in the back half of 2017 – yes, lower as you might have guessed — the wind up was the S&P 500 traded at 18.5x expected 2017 earnings as we exited last week.

Even after those revisions, consensus expectations still have the S&P delivering more than 10 percent earnings growth year over year.

This makes team Tematica go “Hmm” especially given the pairing back of GDP forecasts for the current quarter by both the Atlanta Fed as well as the New York Fed. Lenore Hawkins and I talked about the factors behind those moves on last week’s Cocktail Investing podcast, which if you missed it you can listen to it here.

Following the taping of that podcast, we received the May data for both ISM Manufacturing as well as the Employment Report, neither of which pointed to an uptick in economic activity during the month. The result was the Atlanta Fed revised its 2Q 2017 GDP forecast down to 3.4 percent, from 3.7 percent a week prior. At the same time, the New York Fed kept its 2Q 217 GDP forecast intact at 2.2 percent, but trimmed its 3Q 2107 GDP forecast from 2.0 percent down to 1.8 percent.

Leave A Comment