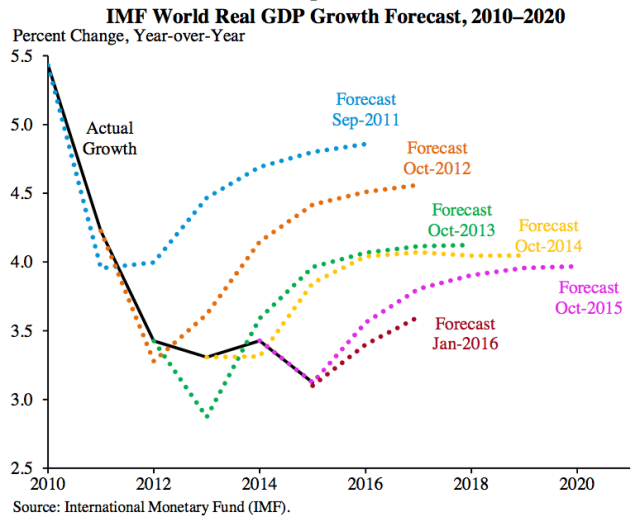

Economic growth never seems to be as high as those making forecasts would like it to be. This is a record of recent forecasts by the International Monetary Fund:

Figure 1. World GDP Forecasts by the International Monetary Fund.

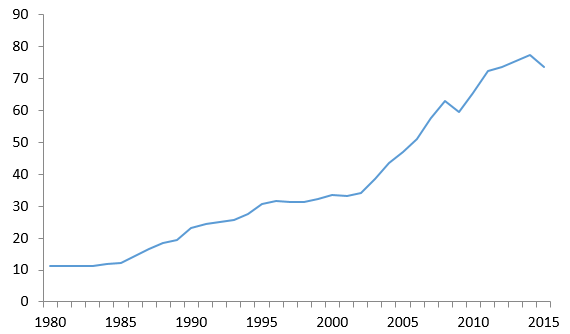

Figure 2 shows world economic growth on a different basis–a basis that appears to me to be very close to total world GDP, as measured in US dollars, without adjustment for inflation. On this basis, world GDP (or Gross Planetary Product as the author calls it) does very poorly in 2015, nearly as bad as in 2009.

Figure 2. Gross Planet Product at current prices (trillions of dollars) by Peter A. G. van Bergeijk inVoxeu, based on IMF World Economic Outlook Database, October 2015.

The poor 2015 performance in Figure 2 reflects a combination of falling inflation rates, as a result of falling commodity prices, and a rising relativity of the US dollar to other currencies.

Clearly something is wrong, but virtually no one has figured out the problem.

The World Energy System Is Reaching Limits in a Strange Double Way

We are experiencing a world economy that seems to be reaching limits, but the symptoms are not what peak oil groups warned about. Instead of high prices and lack of supply, we are facing indirect problems brought on by our high consumption of energy products. In my view, we have a double pump problem.

Figure 3. Double gasoline pump from Torrence Collection of Auto Memorabilia.

We don’t just extract fossil fuels. Instead, whether we intend to or not, we get a lot of other things as well: rising debt, rising pollution, and a more complex economy.

The system acts as if whenever one pump dispenses the energy products we want, another pump disperses other products we don’t want. Let’s look at three of the big unwanted “co-products.”

1. Rising debt is an issue because fossil fuels give us things that would never have been possible, in the absence of fossil fuels. For example, thanks to fossil fuels, farmers can have such things as metal plows instead of wooden ones and barbed wire to separate their property from the property of others. Fossil fuels provide many more advanced capabilities as well, including tractors, fertilizer, pesticides, GPS systems to guide tractors, trucks to take food to market, modern roads, and refrigeration.

The benefits of fossil fuels are immense, but can only be experienced once fossil fuels are in use. Because of this, we have adapted our debt system to be a much greater part of the economy than it ever needed to be, prior to the use of fossil fuels. As the cost of fossil fuel extraction rises, ever more debt is required to place these fossil fuels in use. The Bank for International Settlements tells us that worldwide, between 2006 and 2014, the amount of oil and gas company bonds outstanding increased by an average of 15% per year, while syndicated bank loans to oil and gas companies increased by an average of 13% per year. Taken together, about $3 trillion of these types of loans to the oil and gas companies were outstanding at the end of 2014.

As the cost of fossil fuels rises, the cost of everything made using fossil fuels tends to rise as well. Cars, trucks, and homes become more expensive to build, especially if they are intended to be energy efficient. The cost of capital goods purchased by businesses rises as well, since these too are made with fossil fuels. Needless to say, the amount of debt to purchase all of these goods rises as well. Part of the reason for the increased debt is simply because it becomes more difficult for businesses and individuals to purchase needed goods out of cash flow.

As long as fossil fuel prices are rising (not just the cost of extraction), this rising debt doesn’t look like a huge problem. The rising fossil fuel prices push the general inflation rate higher. But once prices stop rising, and in fact start falling, the amount of debt outstanding suddenly seems much more onerous.

2. Rising pollution from fossil fuels is another issue as we use an increasing amount of fossil fuels. If only a tiny amount of fossil fuels is used, pollution tends not to be much of an issue. Air can remain safe for breathing and water can remain safe for drinking. Increasing CO2 pollution is not a significant issue.

Once we start using increasing amounts, pollution becomes a greater issue. Partly this is the case because natural sinks reach their saturation point. Another is the changing nature of technology as we move to more advanced techniques. Techniques such as deep sea drilling, hydraulic fracturing, and arctic drilling have pollution risks that less advanced techniques did not have.

3. A more complex economy is a less obvious co-product of the increasing use of fossil fuels. In a very simple economy, there is little need for big government and big business. If there are businesses, they can be run by a small number of individuals, with little investment in capital goods. A king, together with a handful of appointees, can operate the government if it does not provide much in the way of services such as paved roads, armies, and schools. International trade is not a huge necessity because workers can provide nearly all necessary goods and services with local materials.

Leave A Comment