WTI/RBOB have extended their post-API (crude build) losses overnight (not helped by IEA forecasts indicating the oil-inventory decline will halt in 2018). However, DOE data perfectly contradicted the API data with a big crude draw and big gasoline build. WTI bounced a little (helped by the biggest production cut since September 2015) and RBOB slumped.

API

DOE

Perfectly contradicting what API said last night, DOE sees a big crude draw and gasoline build…

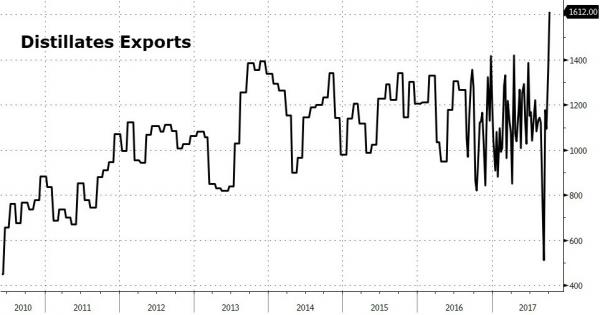

Distillates inventories tumbled below their 5y average as exports soared to a record high…

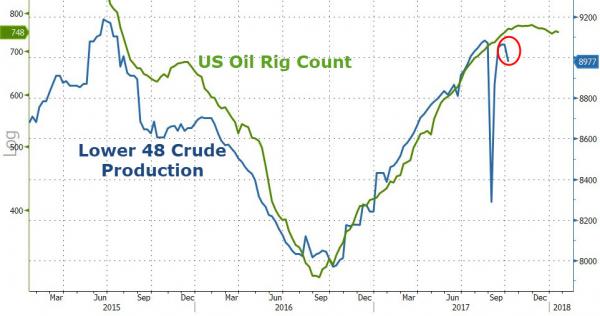

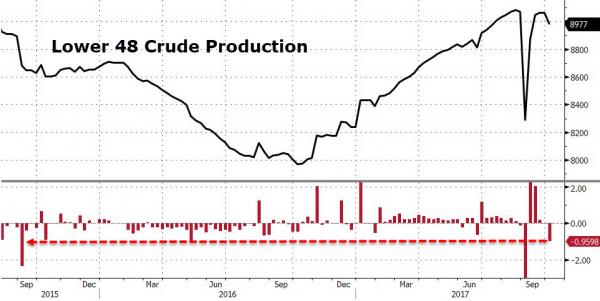

Production in the Lower 48 tumbled…

This was the biggest production drop since September 2015 (ex the Hurricane plunge)

WTI/RBOB prices slid overnight after the API data and were fading into the DOE release. RBOB extended its losses on the gasoline build and WTI bounced…

“It’s a combination of firstly the API last night which gave it the first little knock and then the IEA monthly report which has raised a few eyebrows that we won’t see the rebalancing continue into next year,” says Ole Hansen, head of commodities strategy at Saxo Bank.

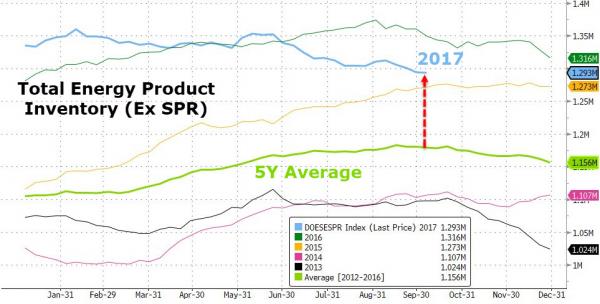

How’s the re-balance going? Total crude and product commercial inventories slipped a bit lower but, at 1.29 billion, barrels are still almost 140 million above the five-year average.

Leave A Comment