The pound had its share of volatility in 2016 and the tendency is not necessarily to the upside, explains the team at BNP Paribas:

Here is their view, courtesy of eFXnews:

The recent slowing in the UK’s dataflow is compounding the effects of political uncertainties and keeping rates markets inclined to price for small risk of policy easing rather than the early 2017 rate hikes that we expect.

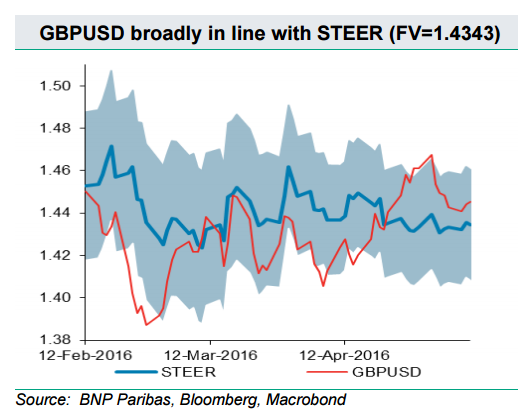

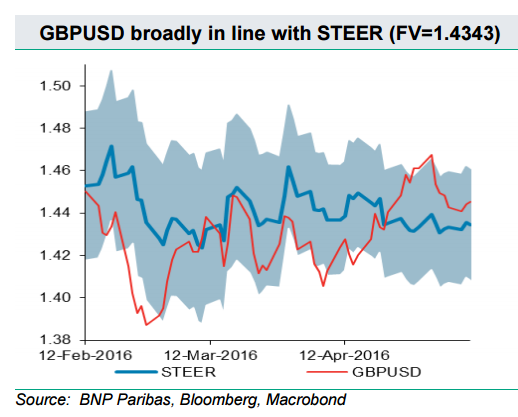

BNP Paribas STEER was last week indicating that the GBP appears overvalued versus the USD, with the decline of cable bringing the pair back towards its STEER. The soft dataflow, in addition to the upcoming political risk, suggests that there is scope for another period of GBP undershooting it’s STEER as has been seen several times this year.

As such, although we have a longer term bullish view for the GBP, risk reward is not attractive for GBP longs at this time.

Leave A Comment