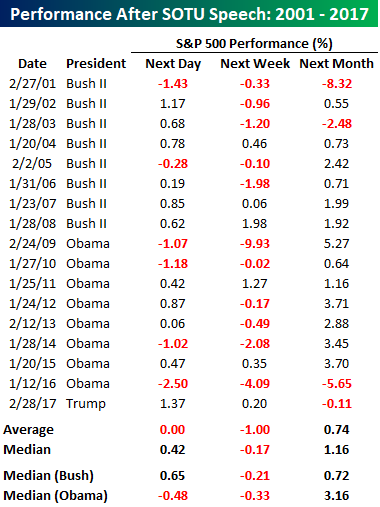

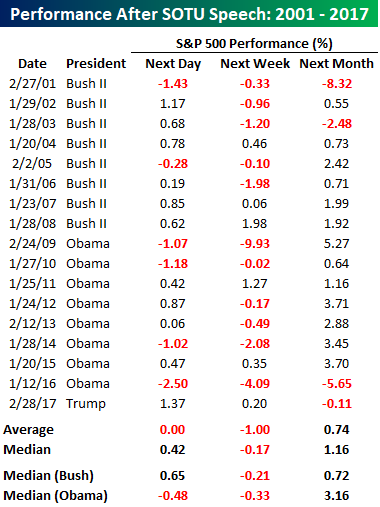

A number of people have asked, so we wanted to provide a quick summary of how the S&P 500 has historically performed following State of the Union speeches by US Presidents since 2001. Given that the speeches take different tones depending on the President and where each one was at in their term, not to mention the state of the economy, it’s hard to say that this speech has any real direct impact on the overall market. Therefore, we would take the performance numbers with a grain of salt.

With that caveat, the one-week period stands out for its overall weakness, while the one-month period has been relatively strong.In the week that has followed SOTU speeches, the S&P 500 saw an average decline of 1.0% with gains in just six of the last 17 years. Regardless of who the President was, the S&P 500 has been down more often than it has been up.

While one-week returns have generally been negative, one-month returns have been much more positive. Since 2001, the S&P 500 has seen an average gain of 0.74% (median: 1.16%) in the month after a SOTU speech with positive returns in all but four years. Under President Obama, the gains were even stronger with the S&P 500 having a median gain of 3.16% and only one year where it was down a month later. Thanks Obama!

Leave A Comment