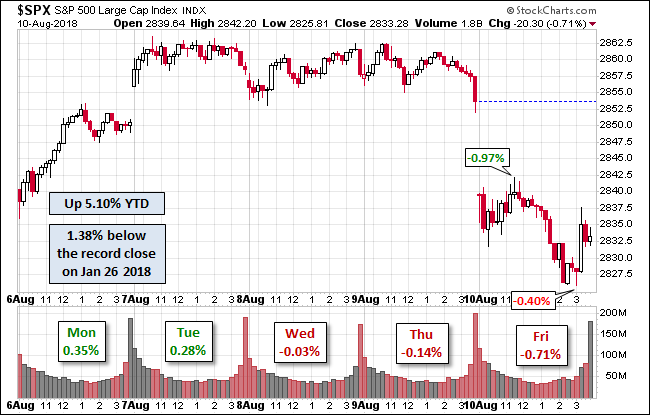

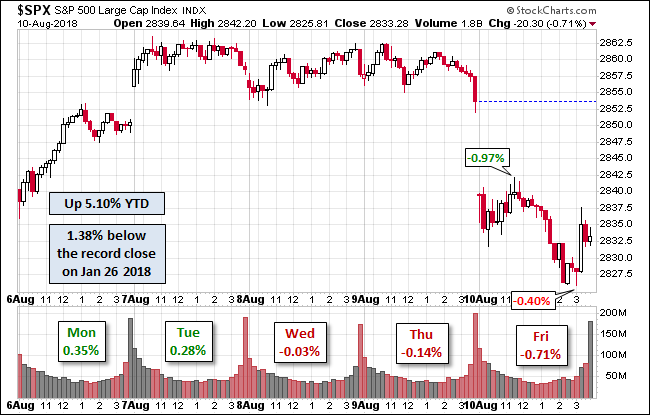

The S&P 500 started Monday climbing, only to stay in a narrow range through the rest of the week, closing Friday down 0.71% from Thursday and below its Monday open. The index closed with a weekly loss of 0.25% and is up 5.10% YTD (as of Jan. 1).

The U.S. Treasury puts the closing yield on the 10-year note at 2.87%.

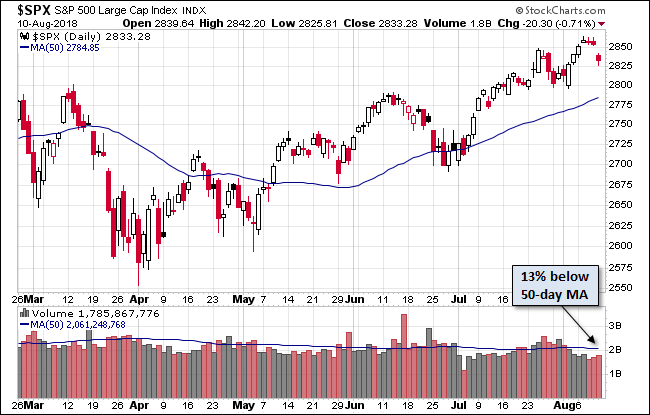

Here is a daily chart of the S&P 500. Friday’s selling puts the volume 13% below its 50-day moving average.

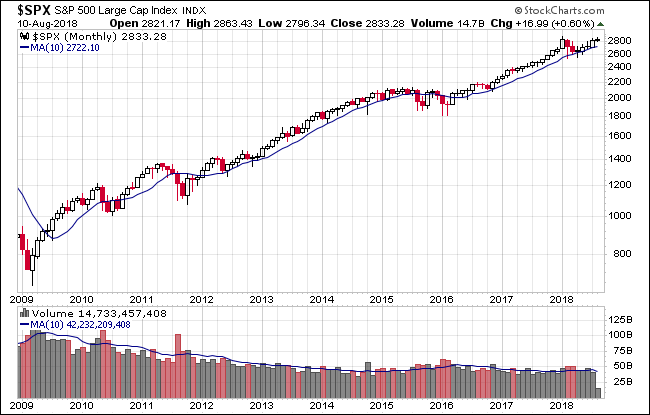

Here’s a snapshot of the index going back to December 2008.

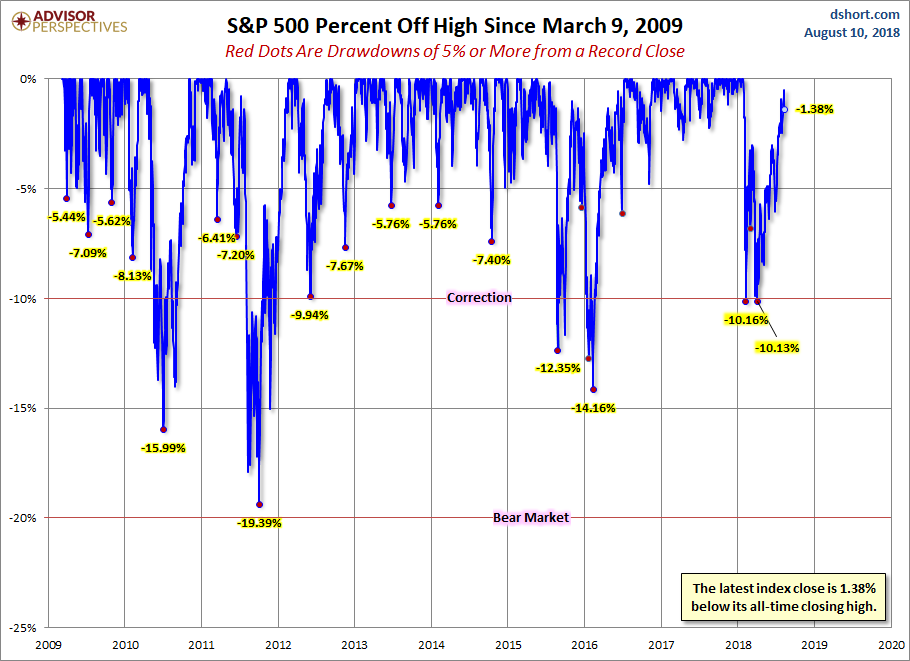

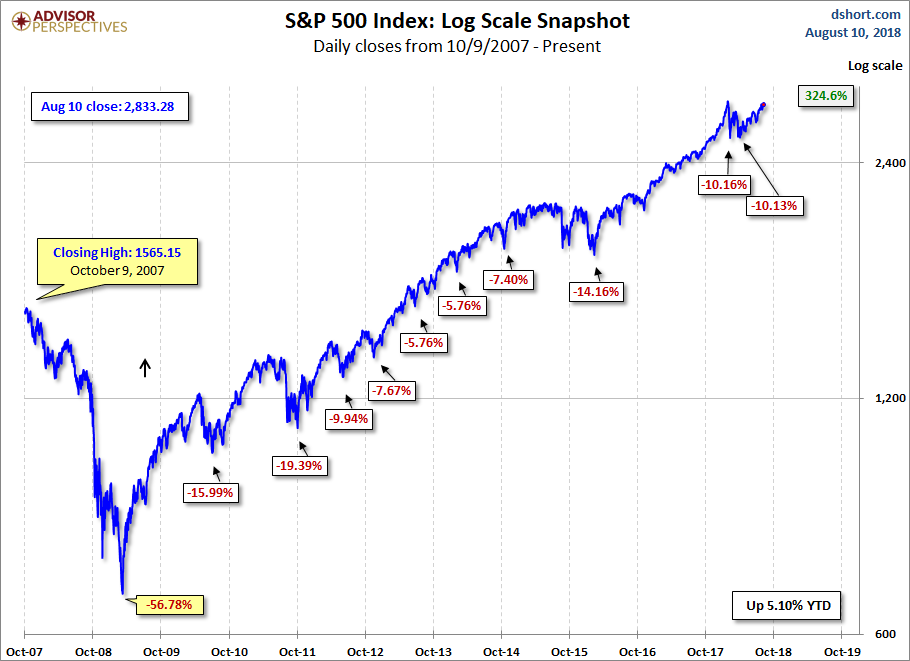

A Perspective on Drawdowns

Here’s a snapshot of record highs and selloffs since the 2009 trough.

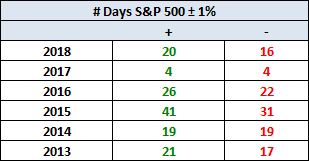

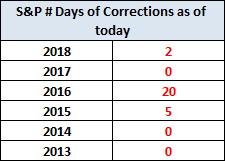

Here’s a table with the number of days of a 1% or more change in either direction and the number of days of corrections (down 10% or more from the record high) going back to 2013.

Here is a more conventional log-scale chart with drawdowns highlighted.

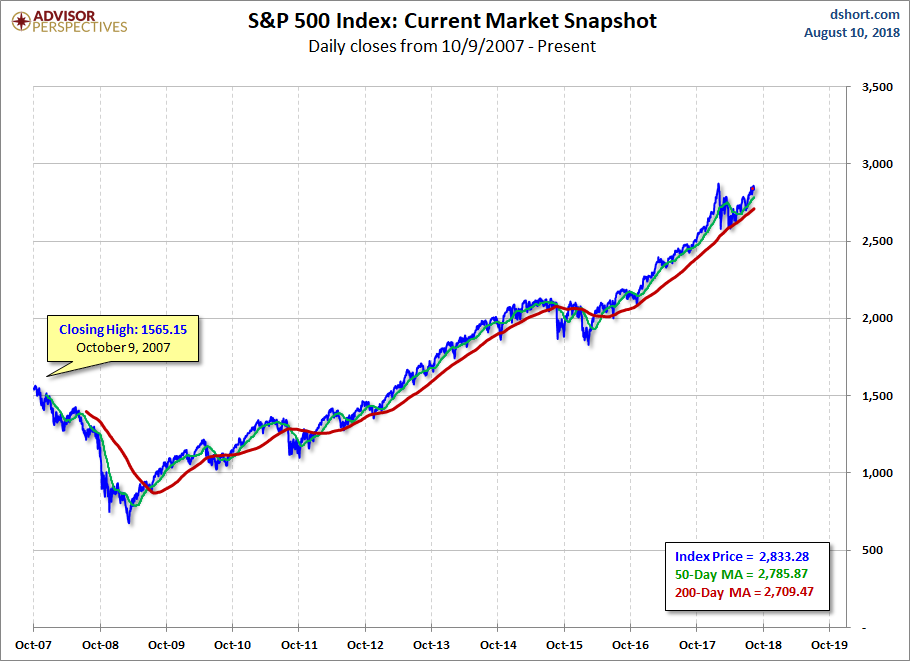

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

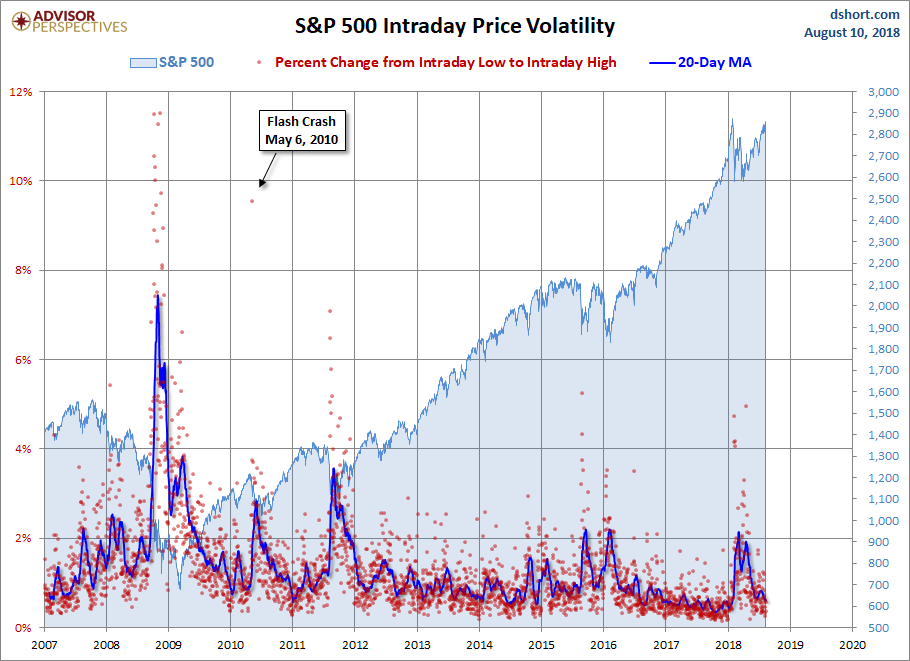

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.

Leave A Comment