Today was a pleasant Friday for markets around the world. Japan’s Nikkei rose 1.08%, the Shanghai Composite 1.60%, the FTSE 0.62%, and the DAX 0.39%. Our benchmark S&P 500 opened higher despite (or because of) another decline in Industrial Production. It bounced off yesterday’s close a couple of times through the day before hitting its -0.17% intraday low around 2PM. The index then stated a modest rally to its 0.46% closing gain, just a tad below its intraday high. This was its third weekly advance, up 0.90% from last Friday.

The yield on the 10-year note closed the session at 2.04%, unchanged from the previous close.

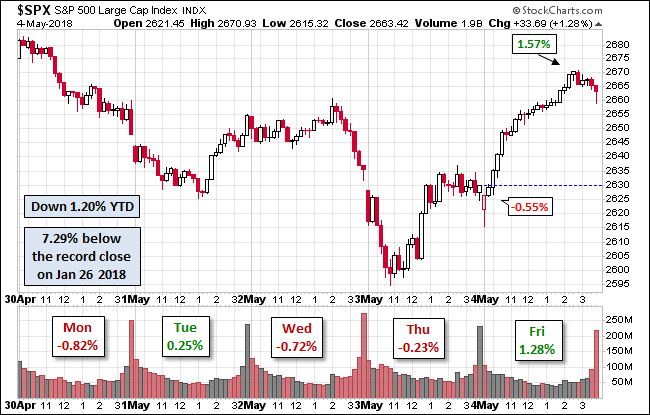

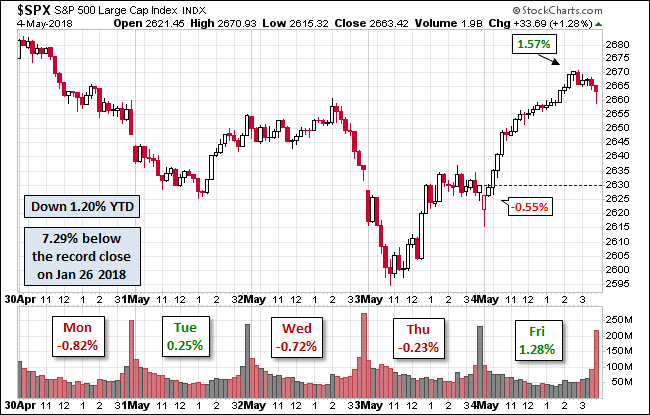

Here is a snapshot of past five sessions.

Volume was unremarkable.

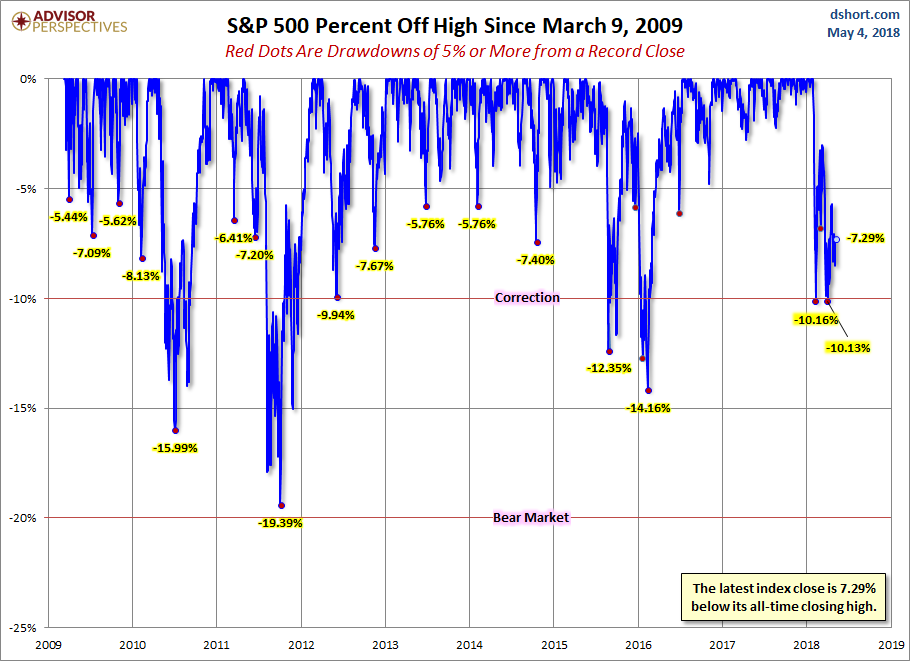

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

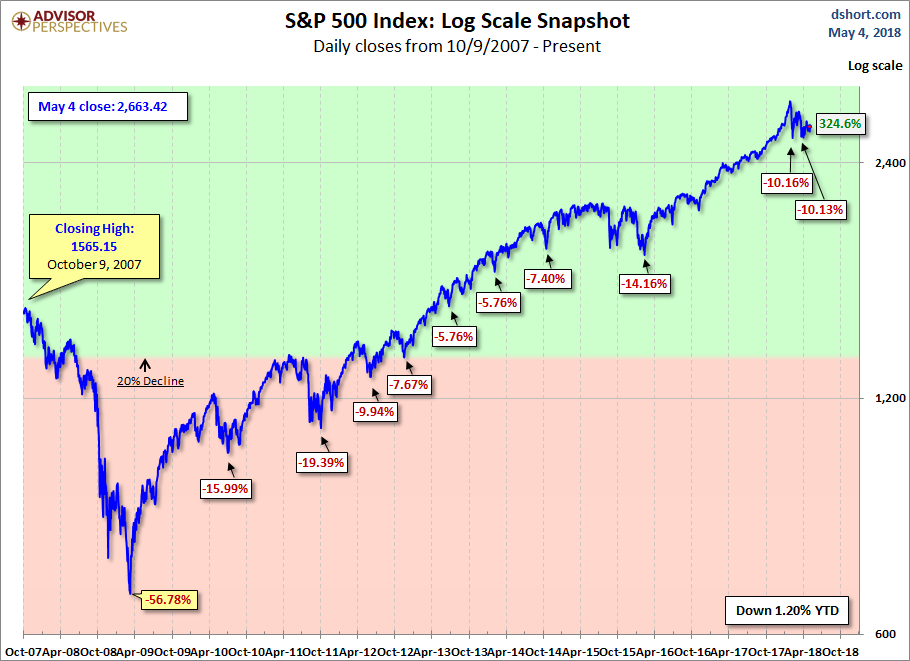

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.

Leave A Comment