December 4, 2017 concludes the 180-day lockup period on ShotSpotter, Incorporated (SSTI).

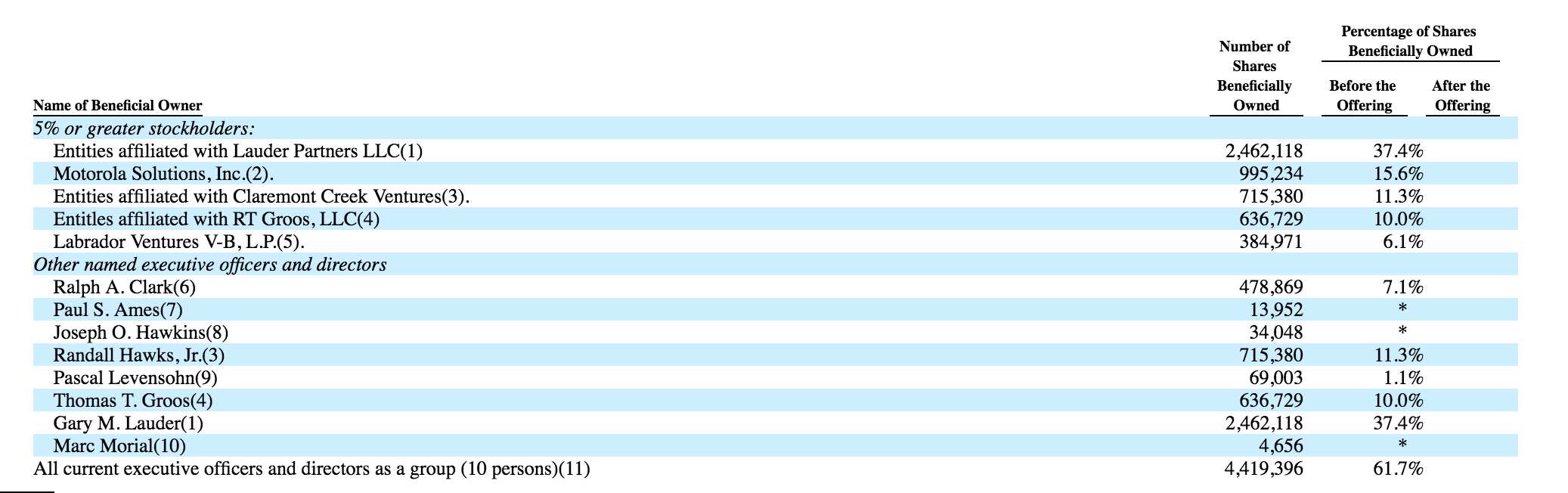

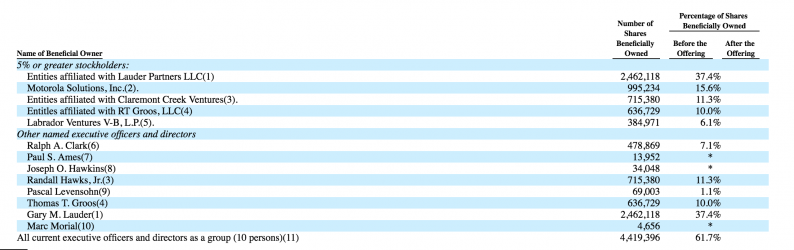

When the lockup period ends for SSTI, its pre-IPO shareholders, directors, and executives will have the chance to sell their approximately 4.4 million shares of previously restricted shares.

The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of ShotSpotter shares. Just 2.8 million shares of SSTI are currently trading.

(Source: S-1/A)

Currently SSTI trades in the $17 to $18 range, above its IPO price of $11 and higher than its first day closing price of $14.38 on June 7, 2017.

Business Overview: Provider of Gunshot Detection Solutions

SpotShotter is a leader in providing gunshot detection solutions that assist law enforcement in deterring gun violence. The software solution is offered on a SaaS-based subscription model. Currently, the company has clients in the United States, Puerto Rico, the U.S. Virgin Islands, and South Africa. Their product, ShotSpotter Flex works within urban, high-crime areas by detecting and locating gunshots and sending real-time alerts to law enforcement. The company also offers SST SecureCampus and ShotSpotter SiteSecure, which are designed to help security on universities, corporate campuses, and critical infrastructure and transportation centers. Their solutions transmit validated sensor data along with a recorded digital file of the triggering sound to the company’s Incident Review Center (IRC). There trained acoustic experts analyze the data and send it along to law enforcement typically in less than a minute. SpotShotter derives its revenue through annual subscriptions based upon deployment of their solutions on a per-square-mile basis. Through March 31, 2017, SpotShotter had 74 public safety clients covering approximately 450 square miles in 89 cities across the United States, including four of the ten largest cities.

Leave A Comment