A well-rounded dividend growth strategy should include income from a number of different sources and styles. Not surprisingly, the ETF industry helps address that need by offering well over 100 different funds utilizing dozens of different strategies. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL), for example, targets companies with decades-long histories of steady dividend growth. The Vanguard High Dividend Yield ETF (VYM) seeks out above average yields, while the FlexShares Quality Dividend Index ETF (QDF) looks for dividend strength and quality. Any of these highly rated ETFs would be an ideal choice for a dividend growth portfolio but most of these funds focus on the large cap space. What about dividend payers from the small cap arena?

One fund I really like is the ProShares Russell 2000 Dividend Growers ETF (SMDV). It uses a nearly identical strategy to its larger sibling, NOBL, in that it focuses on companies that have steadily grown their dividends for years (NOBL looks for 25 years of dividend growth history for its portfolio, while SMDV lowers the bar to just 10 years). Once the fund applies some standard tradability and liquidity screens, it equal weights the portfolio with those companies that qualify and makes sure that no single sector exceeds 30% of the overall fund. Currently, the fund holds 59 names.

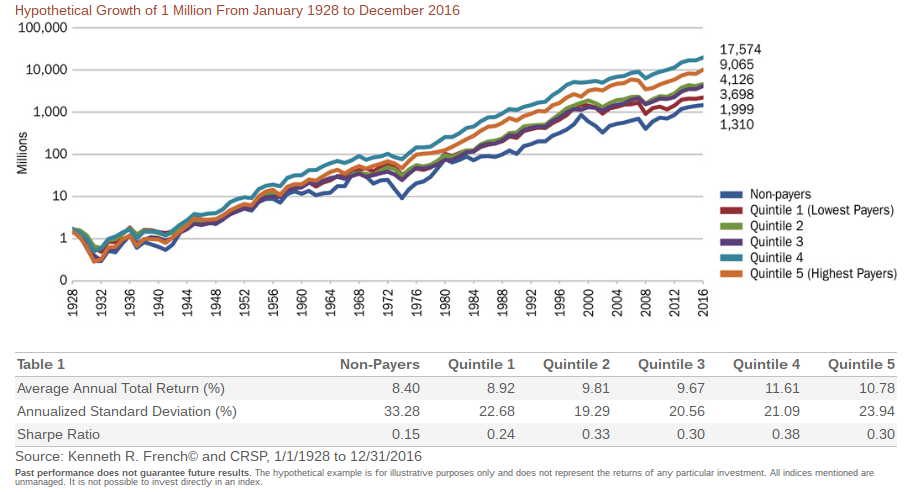

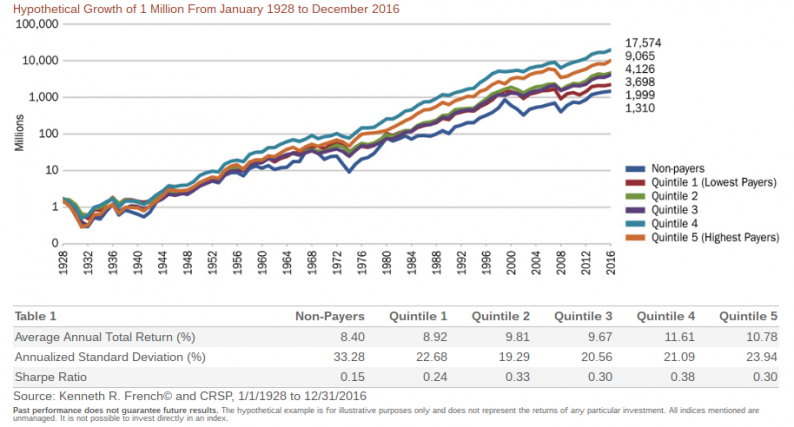

Investing in dividend payers has a long history of delivering above average returns as evidenced by the chart below.

Non-dividend paying stocks as a whole have delivered higher returns with roughly one-third less risk. The sweet spot for dividend stocks is in the middle of the yield range where the risk-adjusted returns using the Sharpe ratio have historically been the highest. During its brief two-year history, the Russell 2000 Dividend Growers ETF has returned an average of 19% annually compared to an 8% annual return for the Russell 2000 index.

While small caps, in general, tend to come with higher risk than the broader market (the standard deviation of daily historical returns for the Russell 2000 Small Cap index is about 20% higher than that of the S&P 500), the focus on dividend payers produces a more conservative value tilt that drops the risk significantly.

Leave A Comment