Thoughts

1 am: VIX suggests that the stock market’s short-term bottom is near.

VIX went up today as the S&P 500 went down. It is now above its 2 standard deviations Bollinger Band. This suggests that the stock market’s short-term downside is limited.

As you can see, VIX’s upper Bollinger Band represented short-term bottoms for the U.S. stock market from February – present. When VIX crossed its upper Bollinger Band, the stock market was either at a short-term bottom or close to making a short-term bottom.

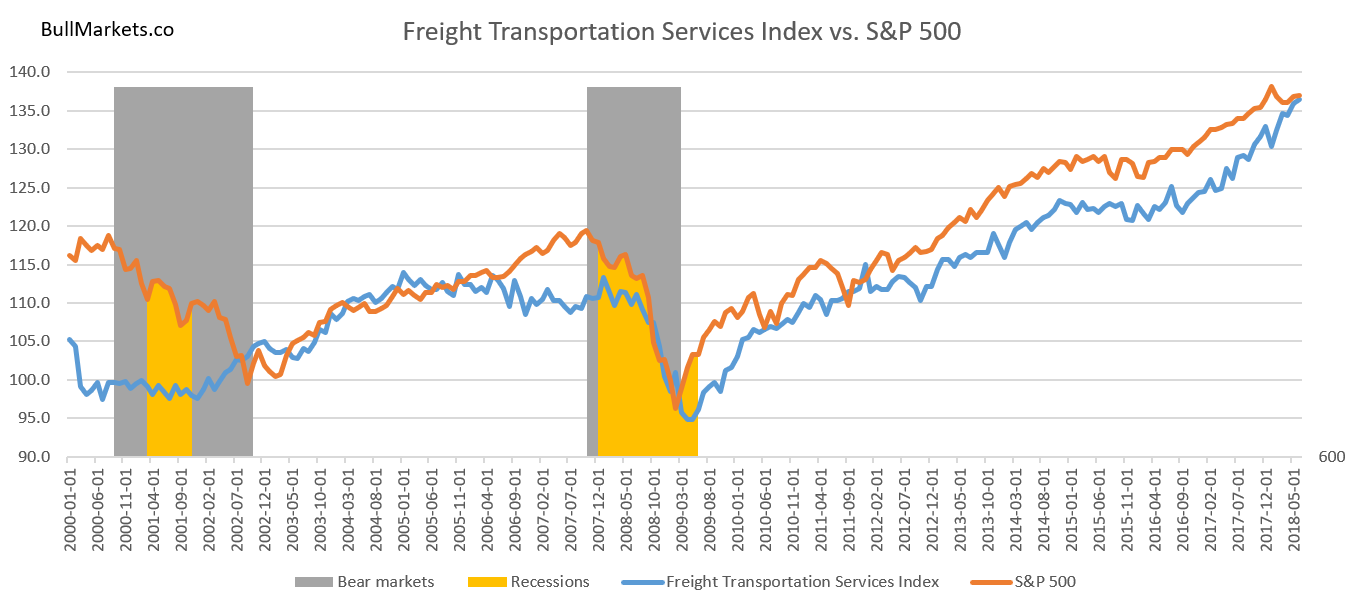

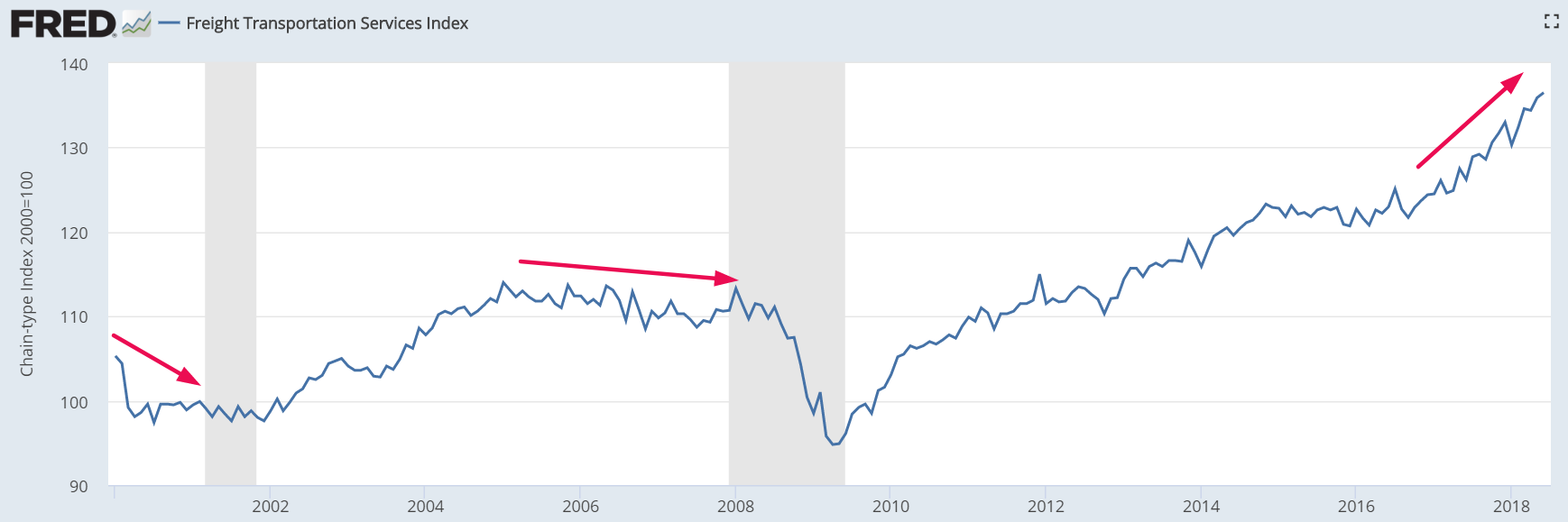

1 am: Freight Transportation Services Index is trending higher. A medium-long term bullish sign for the stock market.

The Freight Transportation Services Index measures the volume of the movement of freight in the U.S. This indicator tends to flatten or fall before an equities bear market or economic recession begins.

The latest reading for the Freight Transportation Services Index made a new high. This suggests that the bull market in U.S. stocks will continue.

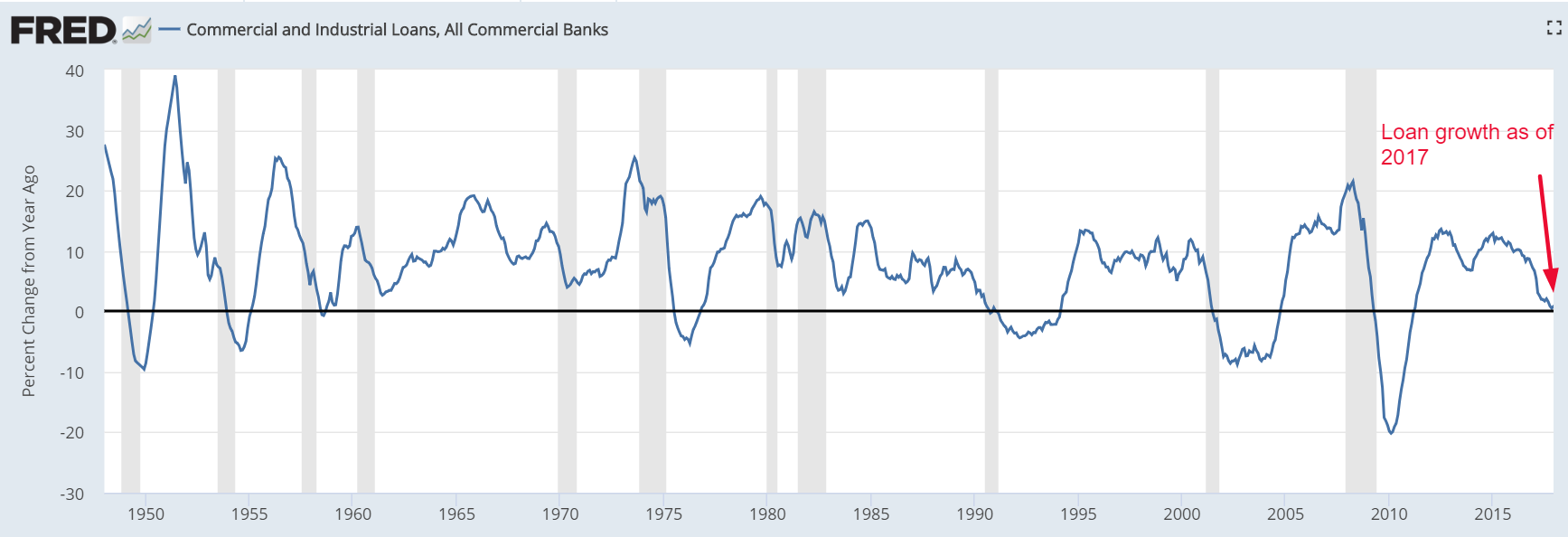

1 am: Commercial and Industrial Loan Growth is trending higher, removing this bearish worry for the stock market.

Last year one of the biggest worries investors and traders had was that Commercial and Industrial Loan growth was trending downwards and on the verge of turning negative.

I said that Loan growth isn’t useful for predicting the stock market or economy. Its correlation with the stock market is mostly random.

Leave A Comment