Two days ago, when observing how the Volkswagen scandal could become a systemic threat to both the German and the European economies we quoted Theo Vermaelen, a finance professor at INSEAD who said “if nobody else has done it, the damage would be limited. If it looks like it’s more companies, not just Volkswagen, it would be a major problem for the German car industry, and the German economy overall.” We added “that’s the question German investors are wrestling with: was it just one cockroach. If it was more, the ultimate outcome will (not may) be more QE from the ECB because with Europe tentative recovery also sputtering after 6 months of ECB QE, a steak through the heart of Germany’s most important industry, will be just the black swan that sends Europe into a recession.”

Earlier this morning it seems the case for more ECB easing is pretty much set following a report by German Autobild that BMW’s X3 xDrive 20d sport utility vehicle “emitted as much as 11 times the European limit for air pollution in a road test, adding to concern that the investigation weighing on Volkswagen AG may spread to other manufacturers.”

According to Bloomberg the SUV was road-tested by the International Council on Clean Transportation, the same group whose tipoff led U.S. regulators to investigate a gap between Volkswagen AG diesels’ emissions in tests and on the road.

The company denied: “There is no function to recognize emissions testing cycles at BMW,” the Munich-based company said in a statement in response to the report. “All emissions systems remain active outside the testing cycles” adding that BMW said that there’s no system in its cars that responds to tests differently than it would operate on the road, but by then the damage was done and

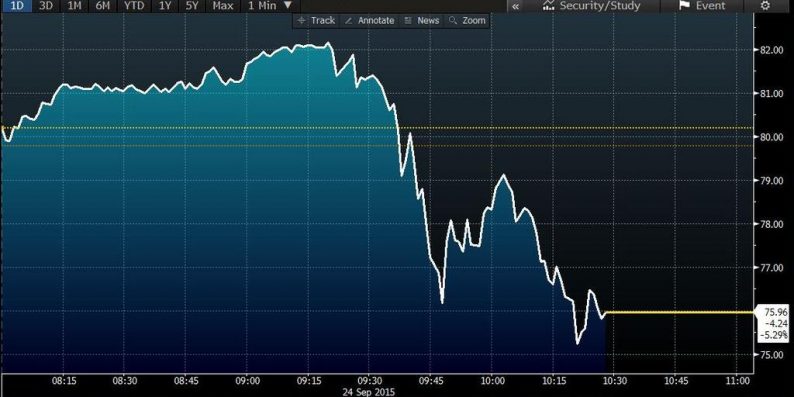

BMW shares traded down 6.2 percent to 74.9 euros at 11:59 a.m. in Frankfurt after dropping as much as 9.3% earlier.

Click on picture to enlarge

“There’s no suggestion BMW has done anything illegal,” said Juergen Pieper, an Frankfurt-based analyst with Bankhaus Metzler. “However, there are concerns for the long-term damage on the business with diesel cars for every manufacturer that builds cars with these engines.”

Perhaps now we know the reason why BMW’s new CEO Harald Krueger fainted last week during the Frankfurt motor show.

Shares of other German carmakers also declined. Daimler AG tumbled below €63 for the first time since November 2014. Volkswagen, which is at the heart of the probe and has lost about 20 billion euros in market value since Monday, recovered some of its losses, rising as much as 7.8 percent.

The news promptly ended the brief kneejerk rebound higher in European equities, which had rebounded earlier on positive German IFO data with expectations and business climate beating surveyed expectations, while current assessment missed expectation, however this failed to have a sustained reaction in the EUR, while elsewhere the USD-index heads into the North American crossover lower by around 0.1 % after seeing relatively muted price action overnight. Finally of note, NZD/USD saw strength after Fonterra revised its 2015/16 milk forecast upward, however mixed trade figures capped further advances in the pair.

In global central bank news – because lately that’s all that matters – ahead of Janet Yellen’s first post-FOMC speech in Amherst, MA on Inflation Dynamics and Monetary Policy in which the Fed chair will be expected to elaborate on last week’s disappointing FOMC announcement, overnight two central banks lowered their interest rates with the Norges Bank unexpectedly lowering their deposit rate by 25bps to a record low 0.75%. 7 of the 17 surveyed analysts forecast a rate cut, citing weaker consumer and business surveys as well as a weaker oil outlook, however the majority of analysts believed that the central bank would hold off until later in the year.

As a result of the rate decision, NOK saw substantial weakness on the back of the release, slumping to its weakest level in more than 13 years versus the dollar after the nation’s central bank unexpectedly cut interest rates to an all-time low and said it may ease monetary policy further to support an economy that’s been battered by the collapse in oil prices.

The krone slid 2.1 percent to 8.4471 per dollar as of 10:11 a.m. London time after reaching 8.4861, the weakest since April 2002. It fell 2.3 percent to 9.4636 per euro, having touched 9.5076, the weakest level since Aug. 26. The Norwegian currency dropped the most against the Swiss franc among its major peers, slumping 2.7 percent. “The move is logical given what they did today,” Carl Hammer, chief foreign-exchange strategist at SEB AB in Stockholm, told Bloomberg. “I thought it was equally likely that they would remain on hold and send a very dovish message, because the krone is already weak. The rate path was reduced substantially. It’s a very dovish message.”

Leave A Comment