Exchange-traded funds (ETFs) that track international markets started the year with tremendous promise that ultimately lost ground to a host of fundamental concerns. Despite the best efforts of the European Central Bank to stimulate economic growth through quantitative easing programs, both developed and emerging markets overseas have seen momentum vanish in 2015.

The hazards in China and Brazil have been well documented and weighed as a primary concern for growth in emerging market countries. In Europe, the fiscally conservative German stock market was rocked by the Volkswagen scandal alongside other financial worries. The combination of these issues alongside the volatility in U.S. stocks has led to wide-spread selling in broad-based indexes over the last five months.

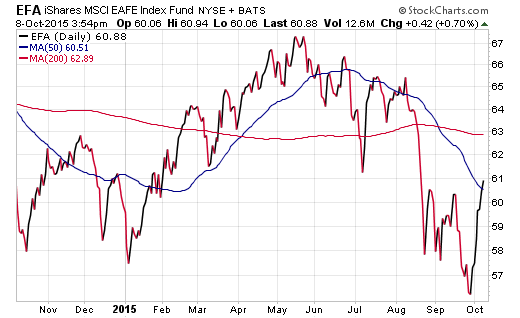

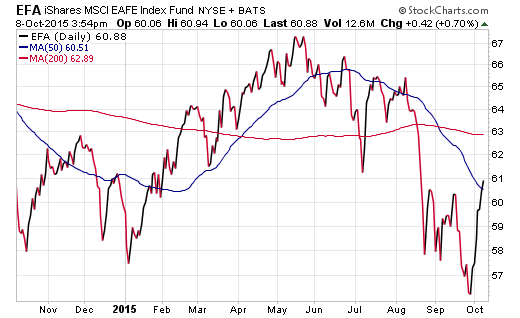

The iShares MSCI EAFE ETF (EFA) is the largest international exchange-traded fund with over $56 billion in total assets. EFA tracks 900 stocks in both developed and emerging foreign markets. In its market cap weighted form, the top country allocations are Japan, United Kingdom, and France.

Since hitting a high in May, EFA has fallen more over 18% to the September low – just barely avoiding a drop into bear market territory. This route was initially started by weakness in emerging markets, but has seen Europe join in to drive prices lower in recent months. Like nearly all risk assets, the October rally has led to some relief of the selling pressure in EFA and barely pushed the index back into the black for the year.

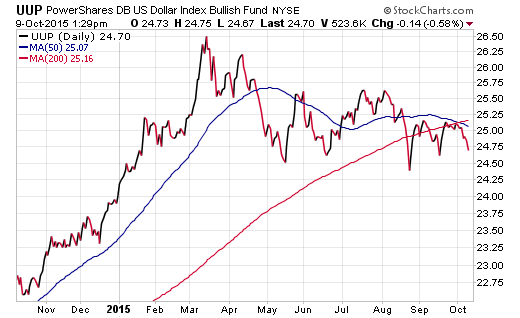

Another key item of note in international markets is the price action of the U.S. dollar, which sent so much money spinning into currency-hedged ETFs at the beginning of the year. The PowerShares U.S. Dollar Bullish Fund (UUP) has been decidedly flat over the last five months. Recent price action may even suggest a mild downside bias, which could lead to a test of support at $24.50 in the near future.

ETFs such as the WisdomTree Europe Hedged Equity Fund (HEDJ) benefitted from the rise of the dollar as the built-in currency arbitrage worked as a tailwind in the first half of the year. Now there is less of a convincing case that the U.S. dollar will continue its rally and lend weight behind the currency hedged theme.

Leave A Comment