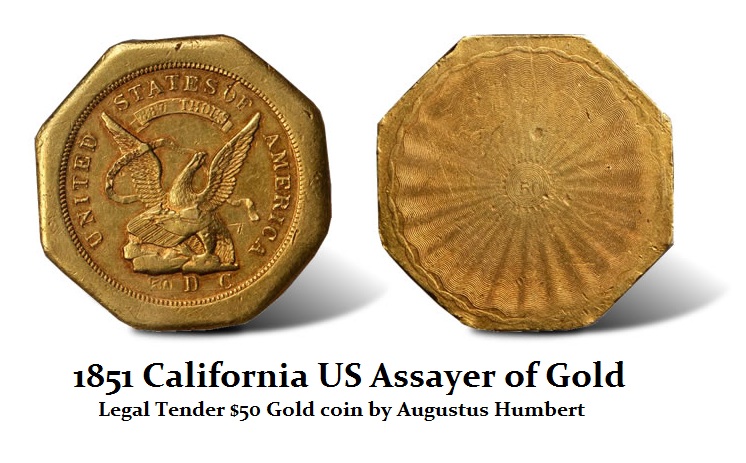

The FT ran a commentary entitled, “The case for retiring another ‘barbarous relic’” on paper money. Money has historically never been a store of value for money is on the opposite side of tangible assets. Even when gold was used as money during the 19th century, its discovery in California was highly inflationary. Rooms for rent in San Francisco ran up to five times the price of rooms in New York City. Gold declined so much in purchasing power on the West Coast that they began issuing $50 gold coins, compared to $20 gold coins on the East Coast. It is simply wrong to pretend that money should be a store of value for to accomplish that requires COMMUNISM where there will never be a fluctuation in the value of anything. It makes for great sophistry, but it hurts a lot of people.

Paper money will ALWAYS rise and fall in value for money is on the opposite side of EVERYTHING else in life from assets (including gold when there is no gold standard) to wages. Eliminating paper money will indeed hand government more power — the power to tax and to prevent anyone from buying or selling without their permission. This is a substantially different result from just changing what we use for money. Moving to electronic money may be more efficient, but alongside governmental power, it leads to economic totalitarianism. This is by no means a future we should embrace with open arms UNLESS we eliminate taxation, which is a barbarous relic from the past back when money was a commodity. Since government could not create an increase in the supply of the commodity, it required taxes to get some back to re-spend. We moved to paper money, but its value solely resides in the confidence people bestow upon the government. There is no longer a need for taxation, as the government need only create more to pay its bills. Restrain that issuance and eliminate career politicians, now we are talking about a future to embrace free of Marxism or Keynesian economics.

Leave A Comment