This past weekend, I discussed what appears to be the markets ongoing melt-up toward its inevitable conclusion. Of course, that move is supported by the last of the “holdouts” that finally capitulate and take the plunge back into a market that “can seemingly never go down.” But therein lies the danger. To wit:

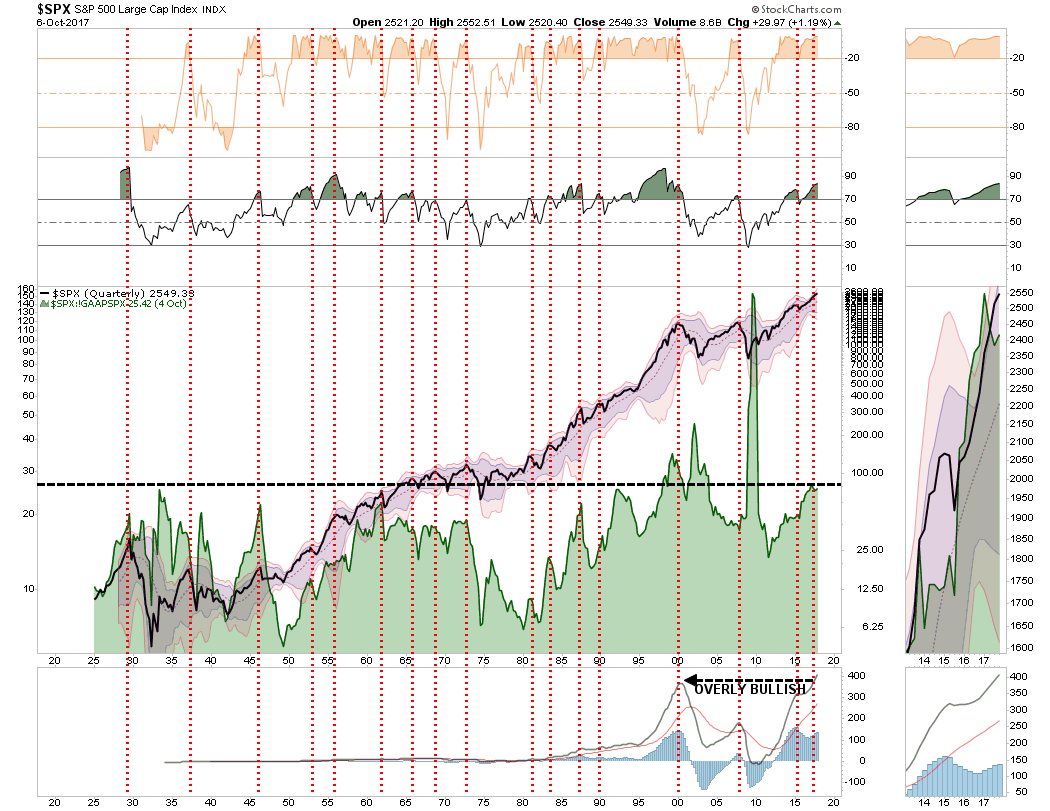

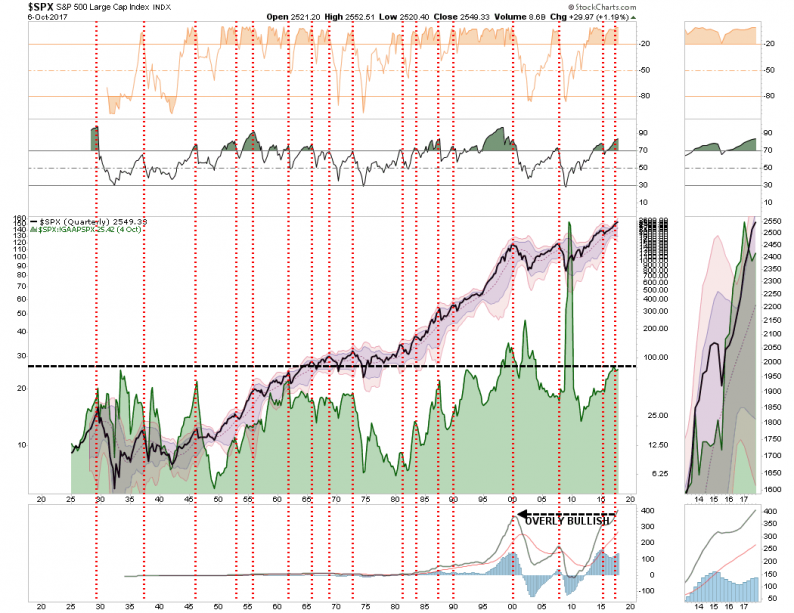

“However, it should be noted that despite the ‘hope’ of fiscal support for the markets, longer-term conditions are currently present that have led to rather sharp market reversions in the past.”

“Regardless, the market is currently ignoring such realities as the belief ‘this time is different’ has become overwhelming pervasive.”

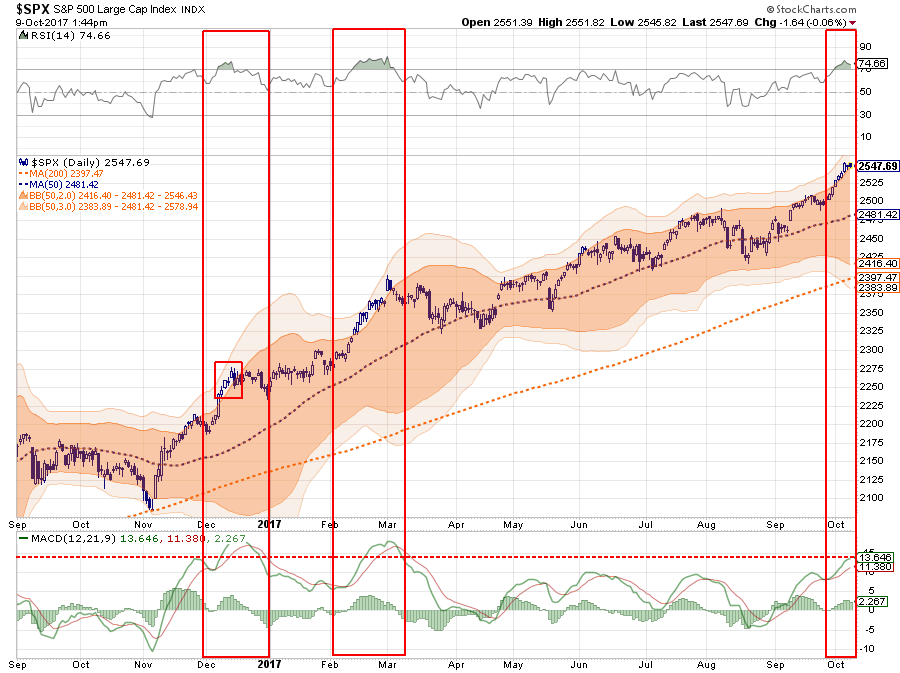

The other problem on a short-term basis is the market is pushing very elevated levels currently. As shown below, with RSI (14) now above 70, the market 3-standard deviations above the 50-dma, and the MACD over 13, in both previous cases over the last year a short-term reversal followed.

A similar outcome would not be surprising this time either, so some caution is advised.

Positioning Review

The COT (Commitment Of Traders) data, which is exceptionally important, is the sole source of the actual holdings of the three key commodity-trading groups, namely:

The data we are interested in is the second group of Non-Commercial Traders.

This is the group that speculates on where they believe the market is headed. While you would expect these individuals to be “smarter” than retail investors, we find they are just as subject to human fallacy and “herd mentality” as everyone else.

Leave A Comment