Two weeks ago we previewed how, in the aftermath of the ECB’s stunning announcement the hedge fund masking as a central bank would start buying investment grade corporate debt, it is only a matter of time before the ECB is forced to buy junk bonds too.

there’s no reason to believe Draghi will stop at IG debt going forward. There’s a kind of one-upmanship going on among DM central bankers and with his massive book full of Japanese ETFs not to mention his monetization of the entirety of JGB gross issuance, Kuroda is still the archetype against which all Keynesian craziness is measured. When judged against the BoJ, the ECB probably still has a ways to go before hitting the limits of central banker insanity and so, we think it’s entirely possible that Draghi moves into HY next.

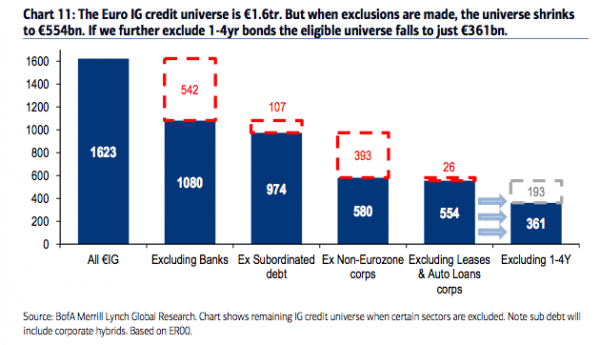

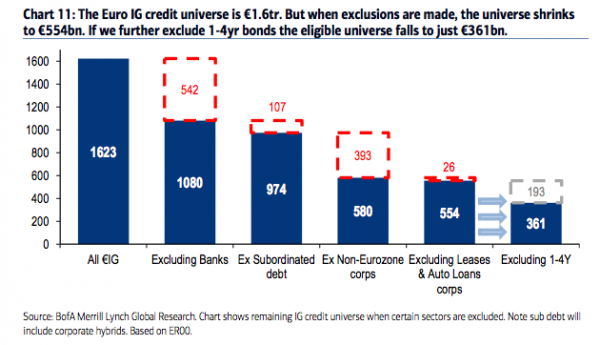

We then cited an analysis by BoA’s Barbany Martin according to which if the ECB wants to avoid getting caught up in having to potentially make decisions on corporate tenders, then it may focus on buying bonds with maturities of 5yrs and higher. “But if we exclude 1-4yr bonds…

… then this shrinks the ECB eligible universe from €550bn to only €361bn – just 22% of the true European IG credit market size.”

Barnaby’s conclusion when looking at the rapidly shrinking universe of eligible bonds: “[this] potentially means that the ECB might have to consider buying BBs down the line.” And after BBs come Bs, CCCs, CCs and so on.

* * *

This was not lost on the market, which is now frontrunning not just what the ECB has announced it will buy but what it may buy, just led to a record European junk bond issuance when French cable and telecom operator Numericable “stunned the market” (as Reuters put it), when it upsized what was originally supposed to be a $2.25 deal by more than 100% to a whopping $5.2 billion bond deal on Wednesday. This was the largest single high-yield bond tranche ever issued.

Leave A Comment