Some people say that gold is dead. They point to deflationary pressures and a bear market that started back in September of 2011. The bulls have been wrong for years; however, that may be about to change…

At present, there are multiple reasons to consider gold:

In the next sections, we will examine the bull case for gold and the risks facing it. In conclusion, we will try to answer the following question: Is this the beginning of a new golden age?

Sentiment & Positioning

In the latest Barron’s Big Money Poll, only 3% of respondents thought that gold was the most attractive asset class. Moreover, 71% were bearish on the yellow metal. Volume traded in GLD (the SPDR Gold Trust ETF) has come down dramatically, which indicates a lack of interest in gold bullion. Volume traded in GDX (miners) and GDXJ (junior miners) has been increasing; however, interest in “gold mining stocks” has been falling since mid-2011. This suggests that traders are trying to catch the falling knife, even though investors are not convinced that gold is undervalued.

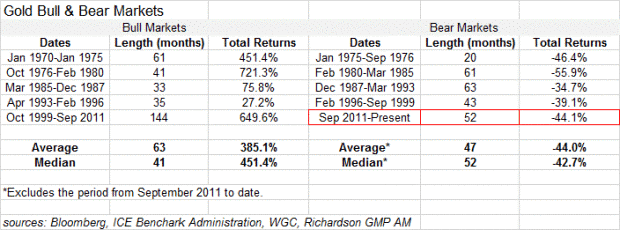

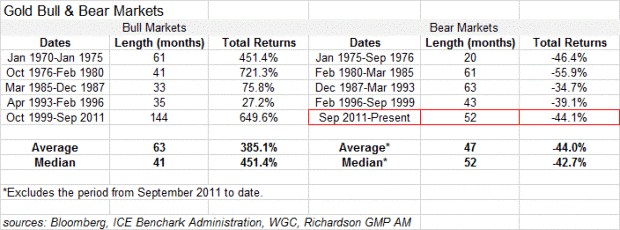

In terms of positioning, market participants are heavily underweight materials and commodity stocks. Is this a contrarian buying opportunity? It could be. Especially because the current bear market is getting old. The following table shows the 5 most recent bull and bear markets:

Gold prices fell by 44% over the 52 months from September of 2011 to January 7th of 2016. Those numbers match the median length and average cumulative return of the previous 4 bear markets. Gold may continue to fall from here; however, we are probably closer to the end of the bear market than to the beginning…

Supply & Demand

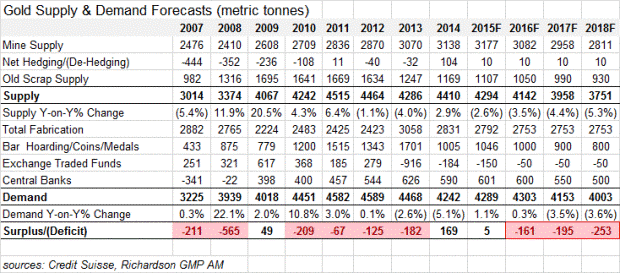

~46% of gold production is FCF negative at current prices. In other words, $1100 is not the equilibrium price. If we stay at these levels then supply will likely decline. Analysts at Credit Suisse ($CS) are projecting a deficit to begin in 2016. They expect that mine supply will fall by 11.5% from 2015 to 2018:

Even at higher prices, gold miners will be unable to replace all of their depleting reserves. Also, it will be very expensive for them to bring new projects online. Lastly, it is important to note that major gold discoveries have become scarce. These trends are negative for supply and positive for prices.

On the demand side, Asia and Europe should continue to support the market. Total bar and coin demand (in tonnes) increased 33% YoY from Q3’14 to Q3’15. Furthermore, consumer demand was up across the board, with exceptionally big numbers in the US. According to the World Gold Council (WGC), “coin sales by the US mint during the quarter were on par with that of Q4 2008.” Another key source of demand is central banks. They have continued to buy as they look to diversify their reserve assets. This speaks to gold’s utility as a portfolio diversifier. Total demand has been falling; however, the quarterly numbers suggest it could be stabilizing. Going forward, consumer demand is likely to offset ETF outflows.

India & China are the main drivers of demand for gold. In 2014, they accounted for ~1710 tonnes of demand. To put that in perspective, 1700 tonnes = 53% of total consumer demand:

Leave A Comment