Last week, James Rickards posted an interesting article discussing the risk to the financial markets from the rise in passive indexing. To wit:

“Free riding is one of the oldest problems in economics and in society in general. Simply put, free riding describes a situation where one party takes the benefits of an economic condition without contributing anything to sustain that condition.

This is the problem of ‘active’ versus ‘passive’ investors.

The active investor contributes to markets while trying to make money in them.

A passive investor is a parasite. The passive investor simply buys an index fund, sits back and enjoys the show. Since markets mostly go up, the passive investor mostly makes money but contributes nothing to price discovery.”

Evelyn Cheng highlighted the rise of passive investing as well:

“Quantitative investing based on computer formulas and trading by machines directly are leaving the traditional stock picker in the dust and now dominating the equity markets, according to a new report from JPMorgan.

‘While fundamental narratives explaining the price action abound, the majority of equity investors today don’t buy or sell stocks based on stock specific fundamentals,‘ Marko Kolanovic, global head of quantitative and derivatives research at JPMorgan, said in a Tuesday note to clients.

Kolanovic estimates ‘fundamental discretionary traders’ account for only about 10 percent of trading volume in stocks. Passive and quantitative investing accounts for about 60 percent, more than double the share a decade ago, he said.

‘Derivatives, quant fund flows, central bank policy and political developments have contributed to low market volatility’, Kolanovic said. Moreover, he said, ‘big data strategies are increasingly challenging traditional fundamental investing and will be a catalyst for changes in the years to come.’”

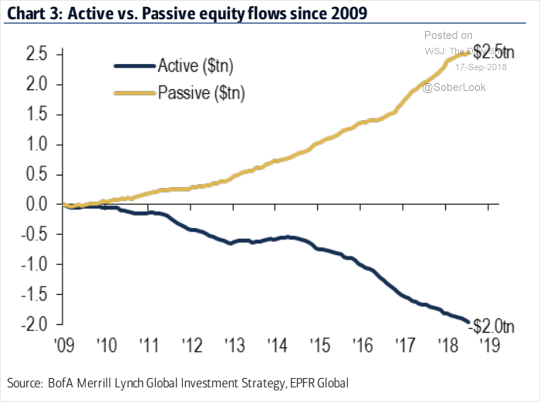

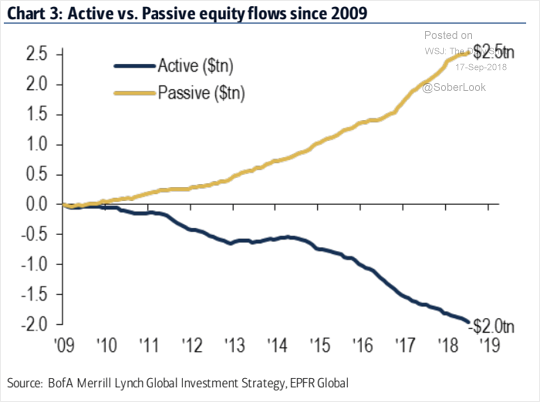

The rise in passive investing has been a byproduct of a decade-long infusion of liquidity and loose monetary policy which fostered a rise in asset prices to a valuation extreme only seen once previously in history. The following chart shows that this is exactly what is happening. Since 2009, over $2.5 trillion of equity investment has been added to passive-strategy funds, while $2.0 trillion has been withdrawn from active-strategy funds.

As James aptly notes:

“This chart reveals the most dangerous trend in investing today. Since the last financial crisis, $2.5 trillion has been added to “passive” equity strategies and $2.0 trillion has been withdrawn from “active” investment strategies. This means more investors are free riding on the research of fewer investors. When sentiment turns, the passive crowd will find there are few buyers left in the market.

When the market goes down, passive fund managers will be forced to sell stocks in order to track the index. This selling will force the market down further and force more selling by the passive managers. This dynamic will feed on itself and accelerate the market crash.”

Leave A Comment