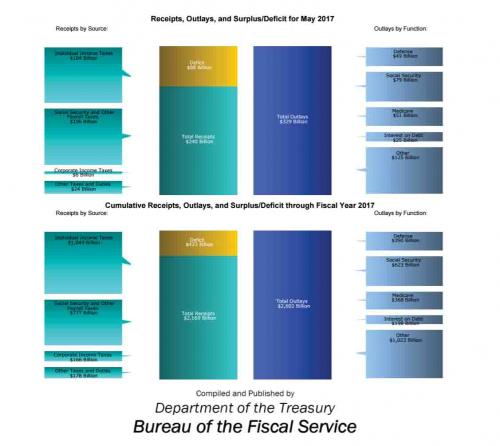

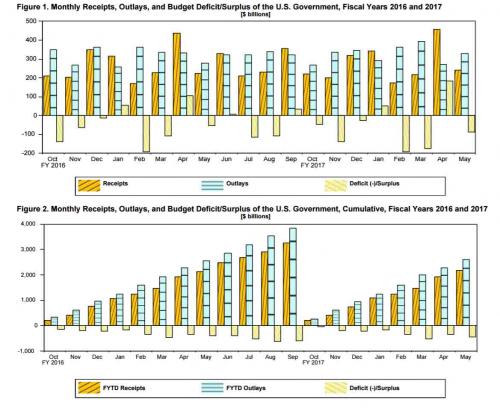

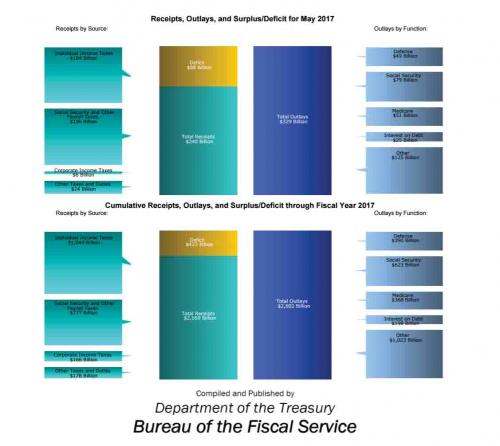

When the Treasury reported its monthly receipts and outlays data for the month of May at 2pm today, it was more of the same: far more spending than receipts, resulting in a 68.4% surge in the US budget deficit compared to a year ago. Specifically, outlays of $329 billion soared 19% compared to a year ago, offset by a modest 7% increase in receipts, resulting in a $88.4 billion deficit in May, more than the $87 consensus estimate, and well above the $52.5 billion a year earlier. The reason: government spending in areas such as Medicaid and defense rose at a far faster pace than revenue.

Year-to-date, the US deficit was $433 billion for the first 8 months of the year compared to $405b last year, with year-to-date receipts rising 1.4%, or roughly 60% of the 2.3% increase in outlays.

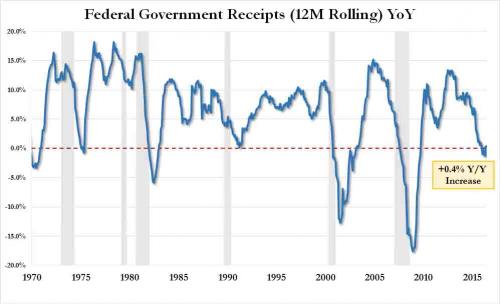

There was one silver lining: after contracting for 4 consecutive months at the beginning of the year, 12-month cumulative government receipts managed to eek out two consecutive months of growth, and rose 0.4% in May.

There was a notable footnote: the Treasury received $8.4b from the Fed in May in deposits of earnings, and $56.5 billion year-to-date as the biggest Pyramid scheme of all time continued, with the Fed remitting billions to the Trasury, artificially boosting the government’s “tax revenues.”

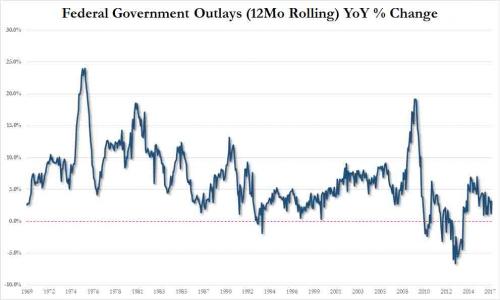

And yet, despite the ongoing growth in the US budget deficit as tax receipts fail to keep up with government spending, a problem has emerged: as shown in the chart below, on an LTM basis, government outlays – the same outlays which soared during the financial crisis to pull the US out of the 2008/2009 hole – have been sliding, and after growing at a 5% annual pace three years ago, are almost back at the flatline as the government, believe it or not, is not spending nearly enough to keep the economy growing.

At the current rate, government “stimulus” is poised to turn negative some time in the next few quarters, if not months, effectively resulting in a drag on the US economy, one which comes at the same time as private sector loan creation is also set to turn negative as we highlighted over the weekend.

Leave A Comment