Image source: Pixabay

Image source: Pixabay

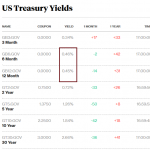

Fed Members Pushback Against Rate Cut ChatterThe US Dollar is trading a little lower across the European trading on Tuesday. The move comes despite a slew of Fed members yesterday voicing their support for maintaining policy at current levels for longer. Fed’s Bostic warned that while he felt inflation would continue to fall, the pace would remain slow, creating the need for the Fed to be patient with restrictive monetary policy. Fed’s Jefferson echoed this sentiment saying that he had been disappointed with the pace of the disinflationary process. Indeed, Jefferson’s comments were arguably more hawkish with the Atlanta Fed president declining to comment on whether he thought the Fed would cut rates this year.

Easing ExpectationsExpectations of forthcoming Fed easing have jumped on the back of the recent April CPI print. With inflation seen cooling for the first time in six months, and the jobs market slowing for the first time this year also, pricing for a September cut has jumped. However, while easing expectations have risen, Fed policymakers have continued to cite the need for restrictive monetary policy to remain in place for longer in order to ensure inflation returns to target. Consequently, we’re seeing USD hemmed in for now as traders struggle to establish a solid directional bias. Looking ahead, tomorrow’s FOMC minutes should create some movement though if members are seen pushing back against rate cut chatter this could see the current stagnation continue for now.

Technical ViewsDXY  The correction lower in DXY has seen the index breaking down through the 104.95 level support. Price is now testing the bull channel lows and with momentum studies bearish, risks of a further sell off are seen. Below the channel, 103.48 will be the next support area to note. Bulls need to see price back above 104.95 quickly to alleviate near-term bearish risks. More By This Author:Ethereum Commentary – Tuesday, May 21Bitcoin Commentary – Monday, May 20FTSE 100 Commentary

The correction lower in DXY has seen the index breaking down through the 104.95 level support. Price is now testing the bull channel lows and with momentum studies bearish, risks of a further sell off are seen. Below the channel, 103.48 will be the next support area to note. Bulls need to see price back above 104.95 quickly to alleviate near-term bearish risks. More By This Author:Ethereum Commentary – Tuesday, May 21Bitcoin Commentary – Monday, May 20FTSE 100 Commentary

Leave A Comment