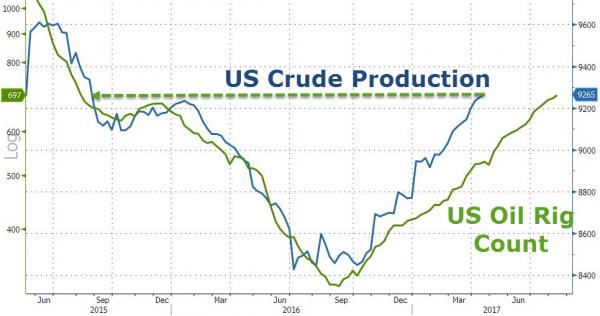

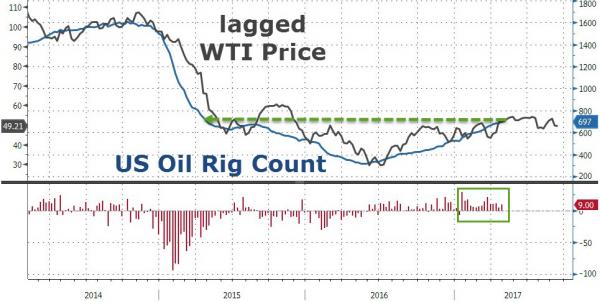

From the May 2016 lows, the number of US oil rig counts have only declined 3 times and this week was no exception. Up for its 15th week in a row (+9 to 697), its highest level since April 2015, the rig count continues to pull US crude production higher, stymying OPEC efforts at balance, leaving the bullish case for oil fading fast.

One might argue that the rig count – which tracks the lagged crude price – may begin to stabilize here…

But crude production – which lags the rig count – has plenty of room to run…

As OilPrice.com’s Nick Cunningham notes, the bullish case for oil is fading fast. Oil (and gasoline) prices have tumbled to their lowest since the OPEC deal was announced last year.

Major investors are also losing a bit of confidence in oil’s comeback. Hedge funds and other money managers took a breather in the buildup, buying up long positions in the most recent week for which data is available. Much of the rally in oil prices between the end of March and mid-April occurred as investors closed out short positions and took on bullish bets. Since then, however, hedge funds have slowed their net-long builds, a sign of waning confidence in higher oil prices.

Also, the futures market no longer looks all that encouraging. The contango is back, a sign of concerns about near-term oversupply. Front-month contracts are trading at a discount to later contracts, a situation that looks more bearish than it did just a few weeks ago. “Keep a wary eye on the Brent contango,” Jan Stuart, energy economist at Credit Suisse Securities LLC, told Bloomberg last week. “Bellwether Brent time-spreads have been counter-seasonally widening.” That is just oil jargon for: “there is too much oil still swashing around and the market is getting anxious.”

Leave A Comment