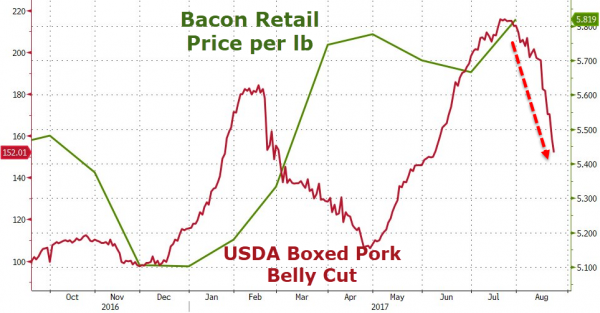

For 99.9999% (our estimate) of Americans, there is great news on the way – retail bacon prices are about to plummet. However, with food accounting for 14% of CPI, we suspect the pork-price-pounding is about to become Janet Yellen’s new ‘transitory’ problem.

In the first half of the year, the best performing commodity in the tradable universe was the USDA Boxed Pork Belly Cut 200lb, which had risen 87% year-to-date, with the media reassuring that the demand was not just seasonal.

For months, many market participants talked of a new paradigm for US pork prices, suggesting that in the future, (like avocado toast) bacon would be added to everything and the public’s appetite for it was insatiable (which makes perfect sense).

However, in the last few weeks, the bacon price has plunged 30%…

Which implies the price of a ‘rasher’ at your local convenience store is about to tumble!!

And as the bacon price collapses, food in general is way down. The CRB FOOD index (US spot foodstuffs) has collapsed (dropping for 8 straight weeks)

(The index consists of: butter, cocoa, corn, hogs, lard, soybean oil, steers, sugar and Minny and KC wheat.)

More good news for Americans with stagnant wages!!

But, given that Janet Yellen and her merry band of piss-poor-prognisticators are desperate for transitory lowflation to pick up (remember they blamed the current downturn on unlimited phone plans), she may have a problem. With food accounting for 14% of the US CPI basket, it is not completely devastating, but does not help Yellen’s cause.

Leave A Comment