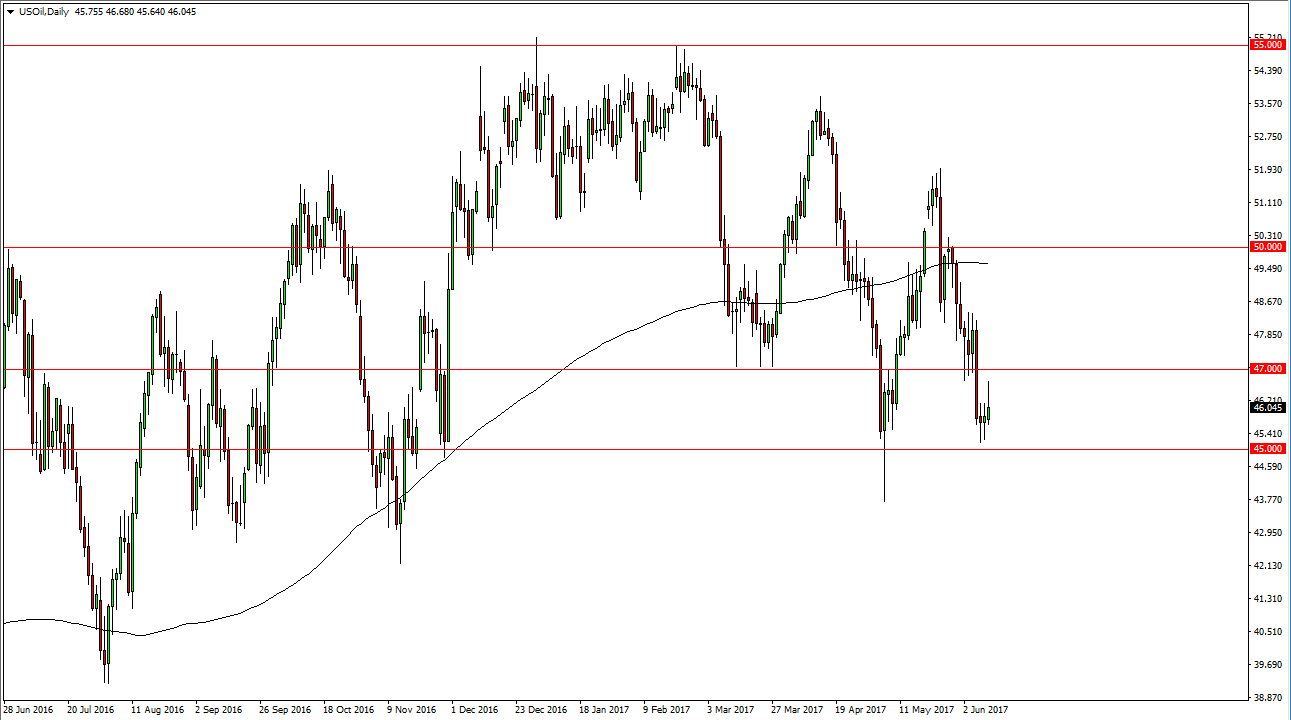

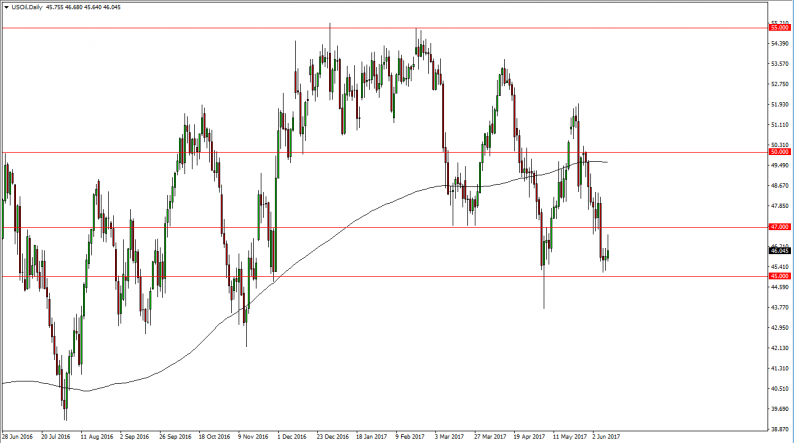

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday, but turned around just below the 47 handle to form a shooting star. This is a very bearish sign, showing signs of negativity yet again. The $45 level underneath continues to be supportive, but I do think that eventually will break down below there, and looking for the $43 level underneath. Ultimately, it looks as if the short-term rallies should offer selling opportunities for those who are quick. The $47 level above is massively resistive, and it’s not until we break above there that I would consider buying this market, and even then I would be a bit cautious. Nonetheless, I believe that the WTI Crude Oil market should continue to sell off as the oversupply glut should continue into the future.

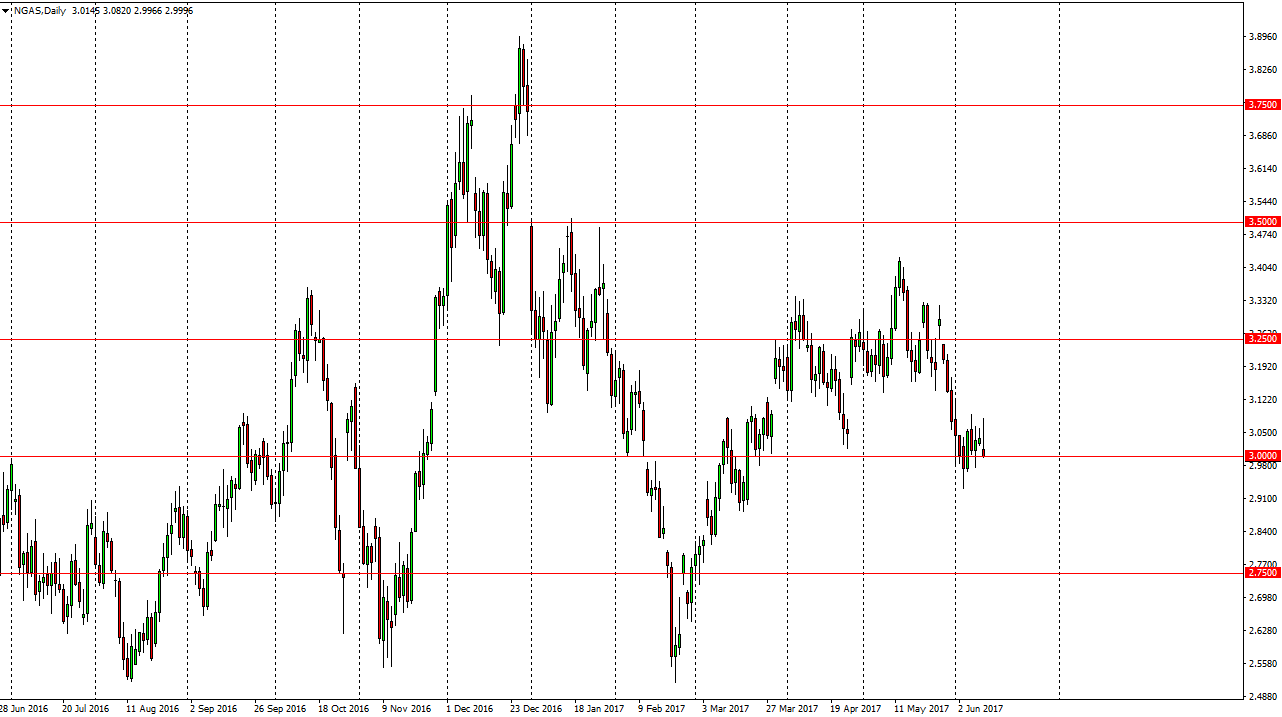

Natural Gas

The natural gas markets initially tried to rally during the day on Monday but turned around to show signs of real strength as we reached towards the $3 level. If we can break down below there, the market should continue to go lower, perhaps down to the $2.90 level. A breakdown below there should send this market looking for the $2.85 level. A breakdown below that, then sends down to the $2.75 level. At this point in time, I think rallies continue to offer and I selling opportunities in what is a massively negative market, as there is an oversupply of energy overall, and natural gas has been in an oversupply situation for quite some time. I think it will remain volatile, but certainly will have a negative bias in general, so having said that I think that the market continues to be short-term, but certainly with a downward pressure. I think if we were to break to the upside, the $3.15 level above would be massively resistive.

Leave A Comment