WTI/RBOB tumbled after China’s trade war retaliation, erasing gains on OPEC’s lowest output in a year, but rebounded after DOE reported a bigger-than-API-reported and surprising 4.6mm barrel crude draw – the most in 3 months. Prices jumped despite a new record high in US crude production.

Crude -4.617mm (+2mm exp, -3.28mm API) – biggest draw in 3 months

Cushing +3.666mm (+4.06mm API) – biggest build since Dec 2016

Gasoline -1.16mm (-1.5mm exp, +1.12mm API)

Distillates +537k (+2.2mm API)

API showed an unexpected 3.28mm draw overnight and DOE confirmed it as even larger – the biggest crude draw since early January. Following the prior week’s biggest surge in Cushing stocks in over a year (and API’s spike), DOE reported a huge-er spike in Cushing stocks this week – the biggest build since Dec 2016.

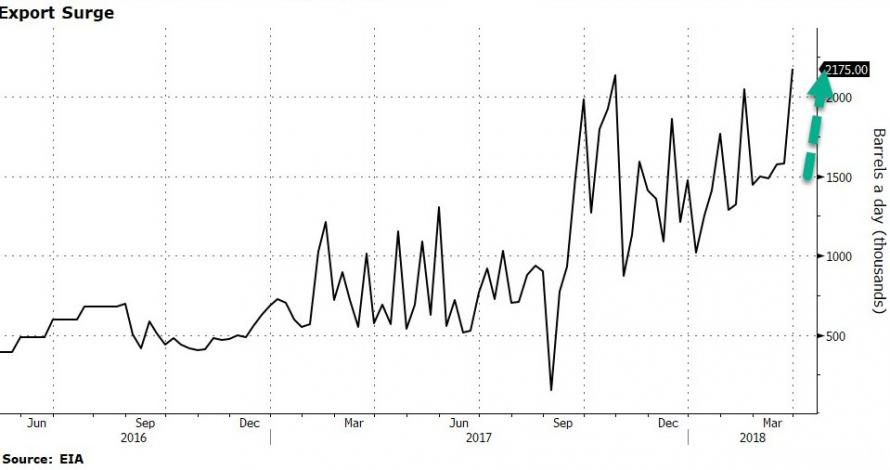

Crude exports rose to a record high…

Output from OPEC’s 14 members fell by 170,000 barrels to 32.04 million barrels a day in March, according to a Bloomberg News survey of analysts, oil companies and ship-tracking data. That’s the lowest since last April’s 31.9 million barrels a day.

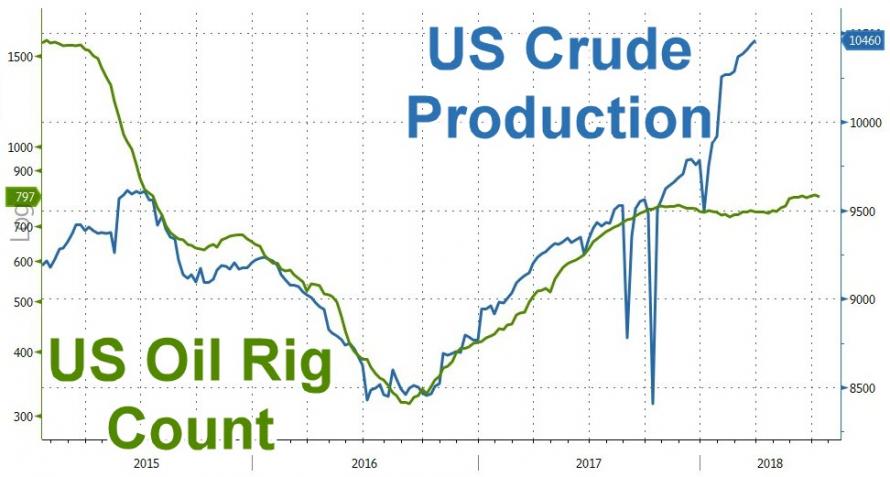

But US crude production remains the center of many OPEC members’ attention… which rose once again to a new record high…

After tumbling overnight on China trade tariffs, DOE data has – for now -sparked a rebound higher..

“It’s only logical to see profit-taking in light of looming trade tensions and possible financial-market turbulence,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt.

Leave A Comment