WTI was higher and RBOB lower after last night’s API (even as the USD rises) but both tumbled after bigger than expected crude and gasoline builds (and a new record high for US crude production).

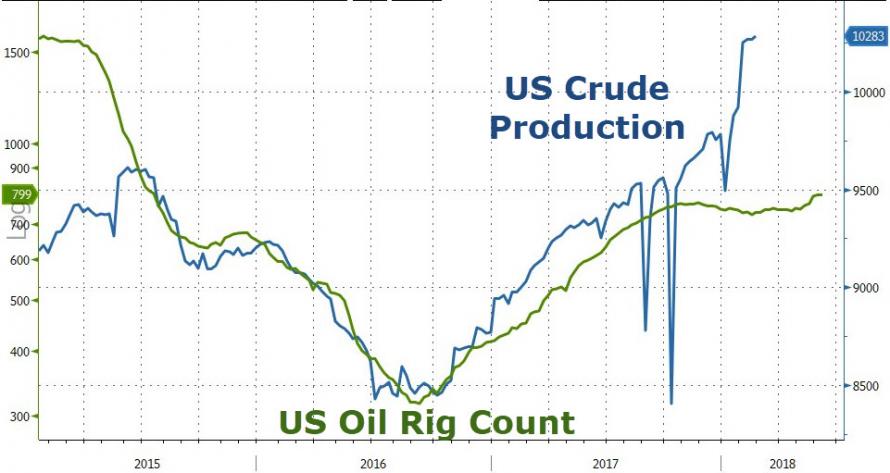

Bloomberg Intelligence Senior Energy Analyst Vince Piazza explained that the crude market is in a holding pattern with oil vacillating around $60 a barrel as E&Ps continue to imply higher output this year. U.S. production is poised to grow about 13% to 10.6 million barrels. Distillate demand remains robust, while summer driving season will be the next catalyst for gasoline use. Rising petroleum exports limit inventory bloat. Inventories are just 2% above the five-year norm.

API

Crude +933k (+3mm exp)

Cushing -1.277mm (-1.2mm exp)

Gasoline +1.914mm

Distillates -1.473mm

DOE

Crude +3.02mm (+3mm exp)

Cushing -1.22mm (-1.2mm exp)

Gasoline +2.48mm (+600k exp)

Distillates -960k (-950k exp)

This is the 10th weekly drop in Cushing stocks in a row and 4th crude build in the last 5 weeks (seemingly signaling last week’s draw as an outlier)…

Total US oil inventory is now its highest since 2017…

Gasoline exports dropped by nearly half last week to 536,000 barrels a day. Looks like the fog-related closures on the Houston Ship Channel could’ve had more of an impact than expected. Exports fell to the lowest level since early October.

Once again all eyes were on US crude production (which dropped by a miniscule amount last week due to Alaska, while Lower 48 rose), and total US crude production rose to a new record this week…

WTI prices had recovered their API loss but once the DOE data hit, both WTI/RBOB tumbled…

Total crude and product stocks grew 3.73 million barrels, and the main products — crude, gasoline, distillate — are 23 million barrels above the December low. The question is, as Bloomberg’s David Marino asks, is this the start of a seasonal increase, or just a pause in a longer-term decline?

Leave A Comment