Asset allocation is widely celebrated as the most-important investment decision, but the details matter… a lot. Indeed, sometimes asset allocation can be your worst enemy, depending on how the strategy is executed.

Case in point: the ten asset allocation funds that periodically appear on these pages (see here and here for background) as a window into this realm. Although these products fall under the general heading of multi-asset class investment strategies, the results at the moment are radically dispersed for the trailing one-year period. That’s a reminder that asset allocation, for all its value as a risk management tool, can become a weapon of wealth destruction if deployed carelessly.

Let’s recognize that asset allocation, even in the best of circumstances, can deliver results that are less than optimal. If this point wasn’t already obvious, it became painfully clear in the meltdown in late-2008, when virtually all of the major asset classes—save Treasuries—suffered sharp losses.

Asset allocation as conventionally defined, it’s fair to say, is prone to failure in periods of extreme market stress. The message is that diversifying across markets is only one facet of designing a “diversified” portfolio. It’s an important facet and generally represents the foundation for intelligent investing. But expecting standard asset allocation alone to shine at all times under all conditions is expecting too much. This is primarily due to market events beyond our control. But sometimes the damage is self-inflicted.

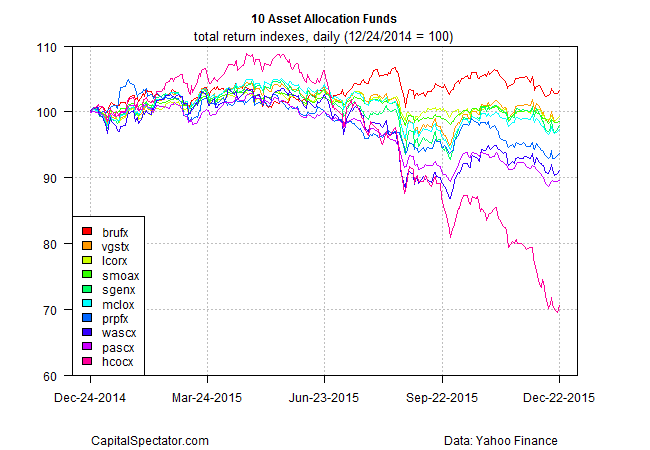

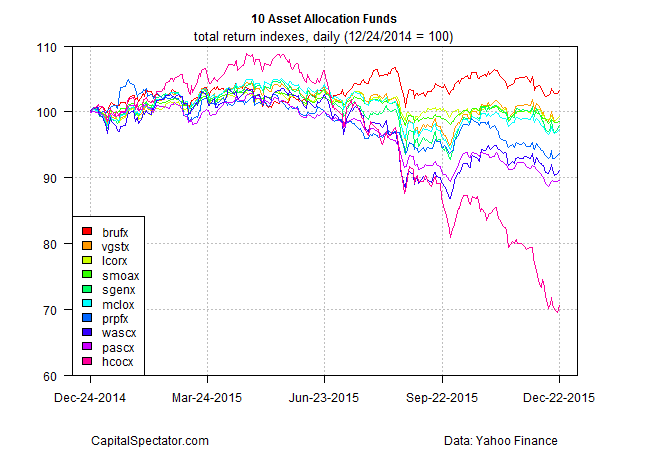

The fallout from the second factor seems to have pinched Highland Global Allocation (HCOCX). As one of the ten asset allocation funds that come under our radar for this column the portfolio’s results have typically been unexceptional. But something seems to have gone quite wrong in recent months, as the graph below shows.

In contrast with HCOCX’s tendency to run with the pack previously, the fund has suffered an unusually steep decline in recent months relative to the competitors in our sample. For the trailing one-year period, HCOCX is off by roughly 30%, mostly due to results in the last three months. By comparison, the rest of the field posts returns that range from a moderate gain down to a 10% loss over the same time window.

Leave A Comment