10 Year Yield – Stocks Stay High Despite High Yields

The Russell 2000 finally increased after a terrible run; it was up 0.92%. The overall stock market was up slightly as the S&P 500 was up just 7 basis points.

The real action today was in the treasury market. An important point about the stock market is it didn’t sell off. The S&P 500 is less than 1% away from its record and it increased with bond yields.

This destroyed the headlines which claimed stocks were falling because of nervousness about yields when the S&P 500 was down earlier in the trading session. Stocks and Treasury yields are much higher than when investors initially feared the 10-year yield hitting 3%.

This was a faulty concern because higher yields mean quicker economic growth.

10 Year Yield – Massive Selloff In The Long Bond Because Of ADP & ISM Data

There is the possibility of the 10-year bond yield surpassing its cycle high of 3.11%. The employment report a pivotal one for the yield. I figured wage growth would play a role in whether it hit new highs.

However, the yield spiked on Wednesday due to either the strong ISM non-manufacturing survey. Or the strong ADP report which implies wage growth will increase in the September BLS report.

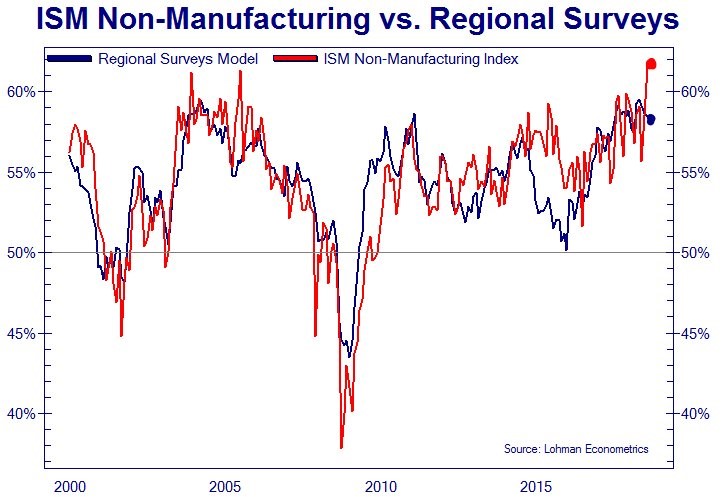

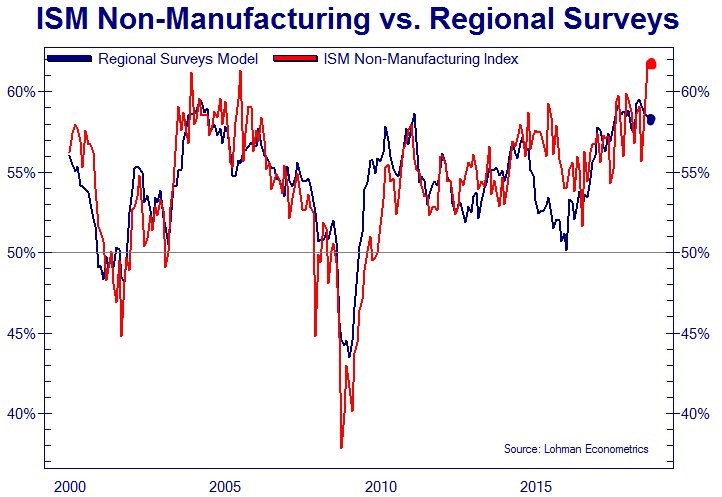

The ISM report was a 5 standard deviation beat. As you can see in the chart below, it wasn’t consistent with the regional surveys model.

The 10-year bond yield increased 11 basis points from 3.06% to 3.17%. This is the highest level this cycle and the biggest increase since November 2016.

It’s amazing that the 10-year yield had a move comparable to the period after the presidential election. The election was much bigger news than the ISM report.

There are a few possibilities which explain this movement.

10 Year Yield – The algorithms took this ISM report at face value.

If employment actually is the strongest since at least 1997 and the services economy is the strongest since 1998, the 10-year yield should increase sharply. My point is the soft data hasn’t been matching the hard data.

Leave A Comment