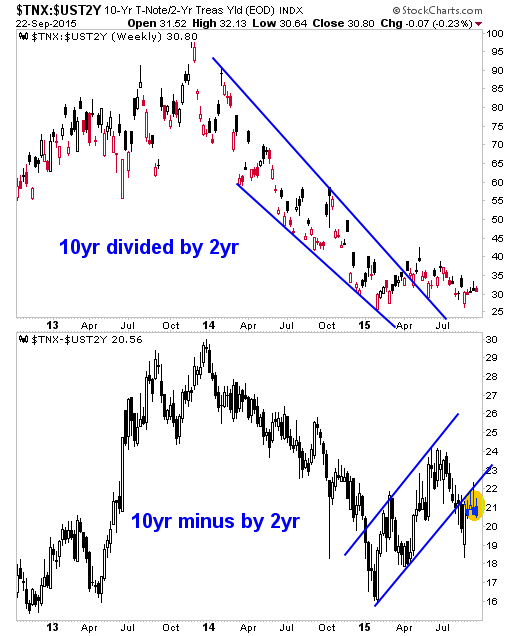

Yesterday Biiwii had a look at the 30’s vs. 5’s, which appear to be bottoming and not a pleasant picture for the stock market. But the most commonly viewed yield spread, the 10’s vs. 2’s is still doing little as it bottom feeds on the 10/2 and loses an uptrend on the 10-2.

This is a neutral stock market picture and given that Operation Twist kicked off the current gold bear market by selling the heck out of very short duration bonds like the 2 year four years ago, still a non-starter for gold.

TED and LIBOR, Palladium vs. Gold, Commodities and Silver vs. Gold, Junk Bonds, etc. are flashing bearish signals. But as of now, the 10 vs. 2 is well under control.

Leave A Comment