“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

– Quote from Warren Buffett

Blue chip stocks are the opposite of penny stocks. They are high quality businesses with long histories of paying rising dividends. Penny stocks are for wild speculators. Blue chip stocks are for serious investors looking for safety and growing income streams.

The definition of a blue chip stock is:

“Stock of a large, well-established and financially sound company that has operated for many years. A blue-chip stock typically has a market capitalization in the billions, is generally the market leader or among the top three companies in its sector, and is more often than not a household name. While dividend payments are not absolutely necessary for a stock to be considered a blue-chip, most blue-chips have a record of paying stable or rising dividends for years, if not decades. The term is believed to have been derived from poker, where blue chips are the most expensive chips.”

This article examines 11 top blue chip dividend stocks of 2015 that are trading for bargain prices.

For a quick list of these 11 stocks – along with their current dividend yields – see below:

Blue Chip Discount Retailer: Wal-Mart

Wal-Mart is the largest discount retailer in the world. The company more-than-satisfies the requirement of a blue chip stock. Wal-Mart has:

In addition, Wal-Mart has a very long history of paying rising dividends. The company has paid increasing dividends for over 40 consecutive years, making Wal-Mart a Dividend Aristocrat. Dividend Aristocrats are stocks with 25 or more consecutive years of dividend increases.

Wal-Mart is a bargain at current prices. The company is currently trading for a price-to-earnings ratio of just 13.4. The price-to-earnings ratios of several of Wal-Mart’s competitors are listed below:

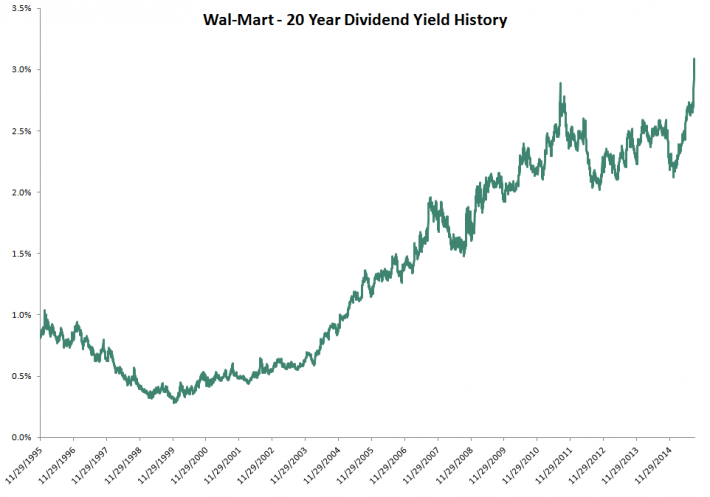

Wal-Mart appears deeply undervalued relative to its peers. The company also looks cheap based on its historical dividend yield. Wal-Mart is currently trading for its highest dividend yield ever. The image below shows Wal-Mart’s dividend yield over the last 2 decades.

Over the last decade, Wal-Mart has grown its earnings-per-share at 7.6% a year. Dividends have grown even faster – at 12.6% a year.

Wal-Mart is investing heavily in the future. The company recently opened 2 new automated online fulfillment centers that are each larger than 20 football fields. Another 2 large fulfillment centers are expected to become operational in the coming 3 months. The company continues to invest in its infrastructure to support growing digital sales. Digital sales are growing at 16% a year for Wal-Mart.

In addition, Wal-Mart is investing heavily to provide a better shopping experience for its customers. The company is doing this by increasing base level employee pay to attract a more talented work-force and better reward current workers.

Wal-Mart’s long-term growth prospects remain bright. The company is very shareholder friendly and has a long history of rising dividends. Further, the company is trading for its highest dividend yield of all time. Now is the time to load up on this blue chip discount retailer.

Blue Chip Farm Equipment Manufacturer: Deere & Company

If you have ever driven through the American Midwest, you likely saw large expanses of farmland. All that farmland requires equipment to maintain and harvest crops.

Deere & Company is the industry leader in agricultural equipment manufacturing. The company has a 60% market share in the United States and Canada.

Deere & Company is a high quality blue chip dividend stock. Warren Buffett would likely agree – he bought into the company this year.

There’s much to like about Deere & Company stock today. The company has paid steady or increasing dividends for 27 consecutive years. The stock currently has a 3.0% dividend yield. Additionally, Deere & Company has grown its earnings-per-share at a stellar 12.7% a year over the last decade.

Even better… Deere & Company is a bargain at current prices. The company is trading for a price-to-earnings ratio of just 12.2. The reason Deere & Company is so cheap right now is because we are currently in a ‘down period’ for crop prices. Crop prices are highly cyclical. When they are on a downswing, farmers tend to put off upgrading their equipment, which reduces Deere & Company’s revenues. The image below shows how most grain prices (with the exception of Canola) have fallen significantly over the last several years.

Simply put, low grain prices have made now the best time to buy this blue-chip farm equipment manufacturer since the Great Recession of 2007 to 2009. Deere & Company’s 20 year dividend history is shown below to illustrate this point:

Leave A Comment