Warren Buffett’s letter to investors in Berkshire Hathaway’s annual reports are highly instructive.

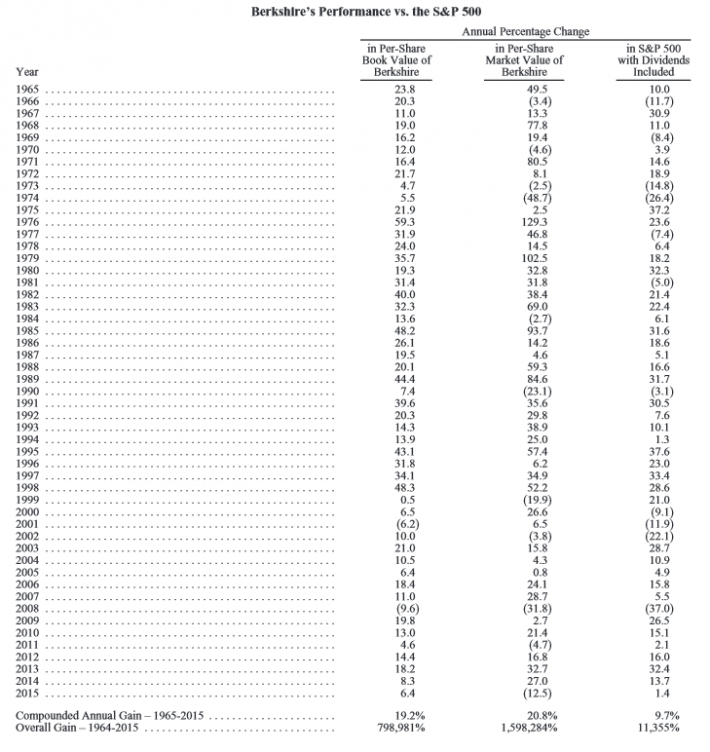

They give insight into the minds of one of the greatest investors of all time. How great? Take a look at the phenomenal long-term track record of Berkshire Hathaway versus the S&P 500:

Source: Berkshire Hathaway 2015 Annual Report, page 2

Warren Buffett is pithy and very quotable. This article examines 15 quotes from Warren Buffett’s most recent 2015 chairman letter.

It also discusses how you can apply these quotes to your investing process.

GAAP vs. Normalized Earnings

“Charlie Munger, Berkshire Vice Chairman and my partner, and I expect Berkshire’s normalized earning power to increase every year. (Actual year-to-year earnings, of course, will sometimes decline because of weakness in the U.S. economy or, possibly, because of insurance mega-catastrophes.) In some years the normalized gains will be small; at other times they will be material.”

Warren Buffett and Charlie Munger do not think in terms of current year GAAP earnings. Instead they look at normalized earnings.They look for ways to allocate capital that will grow normalized earnings every year. This means investing in high quality businesses that are likely to see underlying business growth every year (unless something unusual happens).

Normalized earnings show the underlying earnings power of a business. GAAP earnings can fluctuate wildly from year to year for a variety of reasons. Buffett and Munger focus on the financial metrics that matter

.

How to Apply to Your Portfolio: Don’t be fooled by GAAP earnings. When great businesses experience temporary downturns (like this one), look at normalized earnings instead of GAAP earnings when calculating the price-to-earnings ratio of a business. This process is likely behind Warren Buffett’s recent purchase of Deere & Company (DE).

Todd Combs and Ted Weschler

“Todd (Combs) and Ted Weschler are primarily investment managers – they each handle about $9 billion for us – both of them cheerfully and ably add major value to Berkshire in other ways as well. Hiring these two was one of my best moves.”

Buffett has thought a great deal about his successor. There is no question that Berkshire Hathaway will far outlive both Buffett and Munger.

As a forward looking owner, Buffett does not invest all of Berkshire’s portfolio. Todd Combs and Ted Weschler each invest around 7% of Berkshire Hathaway’s portfolio.

Both Weschler and Combs were hedge fund managers before joining Berkshire Hathaway.

Weschler is in his mid 50’s. His hedge fund Peninsula Capital generated annual returns of around 25% per year from 2000 through 2011.

Combs is 45. He ran hedge fund Capital Point from 2005 to 2010 and is said to have generated annual returns of 34% per year during that time.

How to Apply to Your Portfolio: If you expect your investment portfolio to outlive you (perhaps it is in a trust), be sure to lay out intelligent rules for the management of your assets into the future. Alternatively, find an asset manager that is decades younger than you who will be able to manage your account in a style you feel comfortable with far into the future.

For investors who don’t have this ‘problem’, you can still benefit from outside opinions by looking at the holdings of great investors – like Warren Buffett himself.

The Magic of Insurance Float

“Berkshire’s huge and growing insurance operation again operated at an underwriting profit in 2015 – that makes 13 years in a row – and increased its float. During those years, our float – money that doesn’t belong to us but that we can invest for Berkshire’s benefit – grew from $41 billion to $88 billion. Though neither that gain nor the size of our float is reflected in Berkshire’s earnings, float generates significant investment income because of the assets it allows us to hold.”

Insurance float is ‘magic’ because it is in effect free money to invest. If you got an $88 billion interest free loan, you could make tremendous sums of money every year just from dividend and interest income. That is the magic of insurance float.

“If our revolving float is both costless and long-enduring, which I believe it will be, the true value of this liability is dramatically less than the accounting liability. Owing $1 that in effect will never leave the premises – because new business is almost certain to deliver a substitute – is worlds different from owing $1 that will go out the door tomorrow and not be replaced. The two types of liabilities, however, are treated as equals under GAAP.”

This quote shows how GAAP does not always function properly to value a business. While insurance float is technically a liability because it has to be paid back, it also produces income from investing the float. Float only has totechnically be paid back. As Buffett says in the quote above, if the float is long enduring – meaning it is being reliably replaced, it really is a giant pool of money which can be invested by the company controlling the float.

Leave A Comment