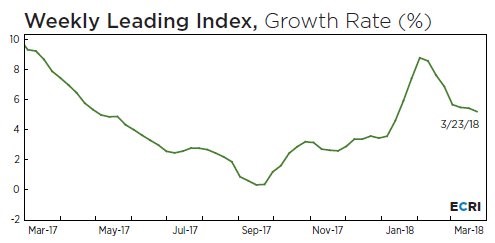

ECRI Index Declines Slightly

As you can see from the chart below, the weekly ECRI index’s growth rate fell slightly from 5.4% to 5.2%. The longer it stays in the mid single digits, the better. This implies the 2nd half of 2018 will see strong economic growth as there will be a re-acceleration after a modest first half. This indicator currently has tough comparisons just like the overall economy. A 2 year stack of double digit growth is a good sign. It appears that the Japanese and European economies are weakening more in Q1 than America, but the U.S. still will see some deceleration from the rapid 2.9% GDP growth rate in Q4.

Latest GDP Forecasts From The Regional Banks

As you can see from the chart below, the Atlanta Fed’s GDP Now forecast has moved up from 1.8% to 2.4%. It has been one of the weakest forecasts. As you can see, the blue chip expects 2.5% growth. The Atlanta Fed’s forecast improved because the forecast for inventory investment’s contribution to Q1 GDP growth increased from 0.66 points to 1.21 points after the wholesale and retail inventories report. If growth is only occurring because of a buildup in inventories, that’s a bad sign because the demand won’t be there to eat up the supply. Eventually, discounting will need to occur to get rid of the supply. This inventory buildup could mean weaker growth in Q2 because less inventory will be bought. Despite the holiday on Friday, neither the St. Louis Fed nor the NY Fed updated their Nowcasts ahead of time. I’ll review their estimates next week.

Inflation Is Still Modest

It’s interesting that the core PCE data is what the Fed focuses on the most and it is the most delayed. The report for February came out on Thursday even though April is a few days away. The month over month change in personal income was up 0.4% which met expectations and was the same as last month. The month over month consumer spending growth was 0.2% which met estimates and was the same as last month. This is a good report considering the fact that retail sales saw a month over month decline. Consumer spending will be critical to GDP growth as always.

Leave A Comment