At the risk of being labeled a reductionist or accused of oversimplifying, my view is with China the key variable is property prices. In fact, if I only had one indicator to look at for China it would be the movement in property prices, simply because they both reflect changes in macroeconomic policy and profoundly influence the short-term economic cycle there. Aside from China itself, the path of the Chinese property market also has important implications for emerging markets and commodities, particularly base metals. And finally, as I note in this article, the path of property price growth can have an interesting and important impact on China A-shares…

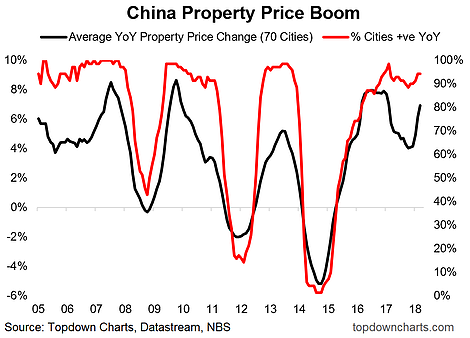

1. China Property Prices – Accelerating Again: Before we look at the 2 key rotations, it’s important to take stock of where things are at right now. After slowing slightly from around the turn of the year, property price growth has re-accelerated in the past 2 months and the breadth of gains have broadened out slightly.

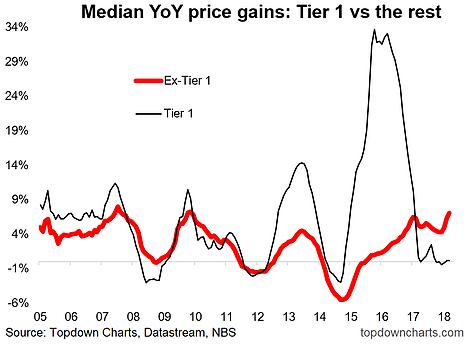

2. A Rotation Underway – Tier 1 vs Smaller Cities: A key reason for this re-acceleration is the surge in prices in ex-tier-1 cities. These markets were initially left behind by the frantic pace of gains in the largest cities (which by the way are now seeing slight declines i.e. Beijing/Shanghai). The broadening out of the property price boom or rotation to the smaller cities creates cyclical upside risk for metals demand and economic growth outside the major cities.

3. Another Rotation Underway – Property vs Stocks: The other key rotation and I think one driver of gains is the downturn in the Shanghai Composite (or China A-Shares in general). With Chinese investors very limited in their investment menu (most are confined to domestic stocks, domestic property, and domestic fixed income – given the restrictions on capital flow and limited availability of offshore investment options)… you tend to see this sort of rotation effect. The marginal speculative investment dollar in China is very active, and I believe what we are seeing here is basically a rotation out of stocks and into property.

Leave A Comment