For the last two years, we’ve taken the time to pause and reflect on changing themes in business and current events. In addition to looking at what got the most “buzz,” we want to mull over the stories that would give you the most edge moving into 2016.

In this illustrated review of the year, the “Hot” (or profitable) items will appear on the left, while the “Not” (or disappointing) corollary appears on the right. We hope you have as much fun reading as we did putting the list together.

For the second year in a row, oil prices have declined as OPEC wages war against North American producers. Cocoa beans, on the other hand, enjoyed a record 2015 – though that may not last much longer.

Vast contrast in CEO behavior leads to adoration for one, and universal disgust for the other. Of course, we applaud Mark Zuckerberg on the creation of his $2.5 billion charitable foundation.

Millenials are setting a new trend, demanding certain selective content – but not paying for bulky cable packages. Providers will either adapt (in the case of HBO Go), or suffer the losses.

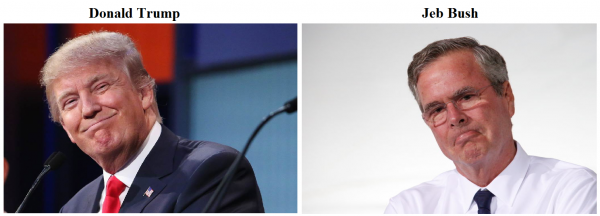

In a year that baffled experts and casual observers alike, the real estate magnate has dominated Republican Primary polls since he first entered the race. On the other hand, the well-financed but low-polling Jeb struggles to distinguish himself in a crowded field.

We were surprised to learn that the world’s largest taxi company doesn’t own any vehicles. Gene Friedman, the Taxi King of NYC, claims Uber is “the nastiest, most morally corrupt company ever.” This article from Bloomberg nicely summarizes the growing rifts in this highly competitive industry.

Joseph Edelman’s Perceptive Life Sciences Offshore Fund was on of the five top performing hedge funds of 2015. Since 1999, it has posted consistently impressive annualized gains of 19.37%. Bill Ackman’s Pershing Square Holdings, on the other hand, took a real beating last year.

Leave A Comment