The final quarter.

The home stretch.

If you took advantage of the small market correction, great job because the market has “recovered” about 6% already.

The last thing you should do is take advice from what you hear on TV or the radio because that’s where the peak of herd mentality exists.

The talking heads don’t provide any deep insight or outside views as it’s their job to provide simple outer layer analysis so that any average Joe can understand.

You actually come out smarter if you ignore everything they say.

Here’s a look at what I mean.

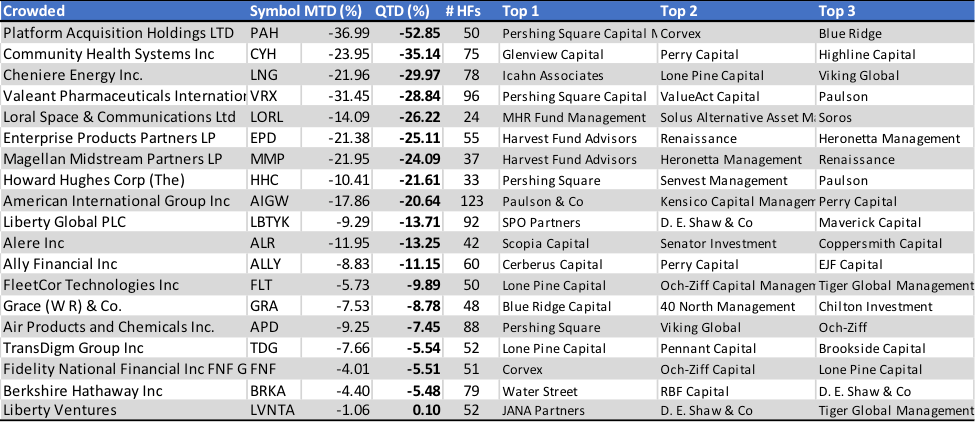

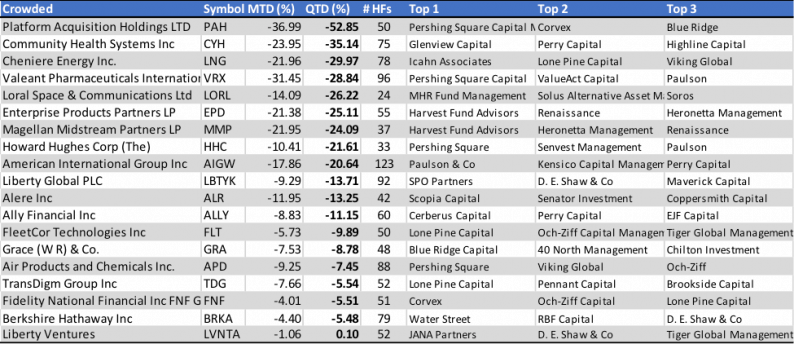

This is the performance of the top 20 stocks held by hedgefunds according to novus.com

2015 Q3 Top 20 Hedgefund Stocks | Credit: novus.com

How does this look in a chart?

Horrible Performance of Hedge Fund Top Picks

Not impressive.

Especially when people running these funds are supposed to be Ivy League top 0.1% brains.

It’s quite easy to avoid these “top 20? names.

Investing doesn’t have to be complicated. Most of the investments above have complicated stories. If you’re looking for a simple business and investment thesis to understand, don’t look at hedge fund holdings.

This is GREAT news for people like us.

After all, the advantage that small investors and fund managers have is that we don’t have to play by their rules.

It’s perfectly within the rules to resist the steady drumbeat of calls to activity.

So how does it look on the value side?

Value Investment Strategy Performances 2015 Q3 YTD

Even though on I’m on the value side, it’s not easy.

It’s not supposed to be easy. Anyone who finds it easy is stupid. – Charlie Munger

At the end of each quarter, I take some time to see what’s working and what isn’t working with a list of predefined value stock screens I follow.

Leave A Comment