Analysts Have Been Very Bullish

Every year analysts are bullish. Heading into 2008, analysts expected the S&P 500 to go up when you use their bottom up target price estimate. It’s not a bad idea to expect stocks and earnings to move up each year since they usually go up. For sell side research, it’s better to be wrong about being bullish than wrong about being bearish. Investment banks needs investors to make a lot of trades and stay in the market to make money. The point I’m making is to take estimates with a grain of salt. I’m more concerned with the changes in earnings expectations than the original estimates because they always tell the same tale.

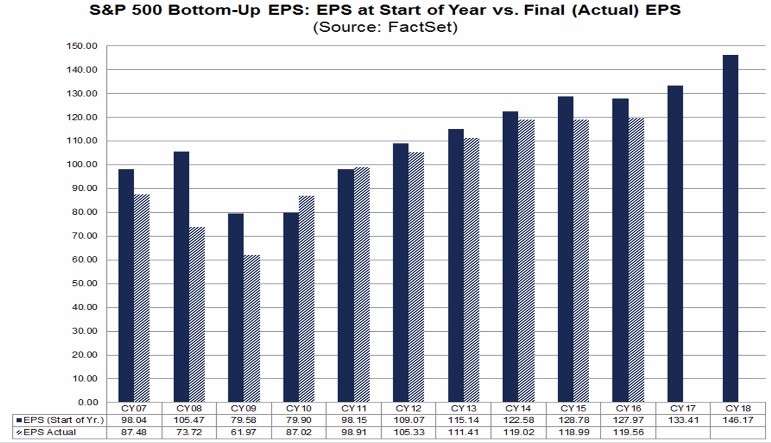

The chart below shows the earnings estimates at the start of the year compared to where they ended up. As you can see, in the past 10 years the actual results beat the start of the year estimates twice. The start of the year consensus EPS estimate for 2017 was $133.41. The current estimate is for $131.73. That is a 1.26% decline which is better than average. The average overestimate in the past 20 years has been 8.6%. 15 out of the past 20 years were overestimates. In theory, if the average were to continue for next year’s estimate, there would be an earnings decline in 2018. However, using the average would be wrong because recessionary years bring it down. Without those 3 years, the average overestimate is 3.7%. If you assume the current estimate for 2017 is reached and the 2018 earnings miss by 3.7%, the 2018 year over year earnings growth would be 6.8%. The main takeaway is it’s probable that earnings growth won’t be in the double digits next year. This doesn’t include the effects of the tax cut which could push earnings growth higher. 2018 would have been a tough year because of difficult comparisons, but the tax cut could alleviate that struggle.

The chart below compares the bottom up price target to the actual change in the S&P 500. This year, the analysts were too pessimistic as the market is up 17.8% while they expected a 9.97% gain. Next year, analysts are expecting about a 7.7% gain. Excluding 2002 and 2008, the average difference between the estimate and actual results is 3.1%, meaning the estimates were 3.1% too high. If that average continues, the S&P 500 would only go up 4.3%. This is in line with what I’m expecting. Since such precise predictions act as if the person has a crystal ball, I’ll say I’m expecting a 5% to 10% increase in the S&P 500 without looking at the tax cut. It’s tough to say how much the tax cut will help equities in 2018, since stocks have been rallying for a few weeks as the chances of it passing rise. In the next few weeks, we’ll look at more analysis to get a better idea how the corporate tax cut will affect earnings.

Leave A Comment