Most Assets See Low Volatility

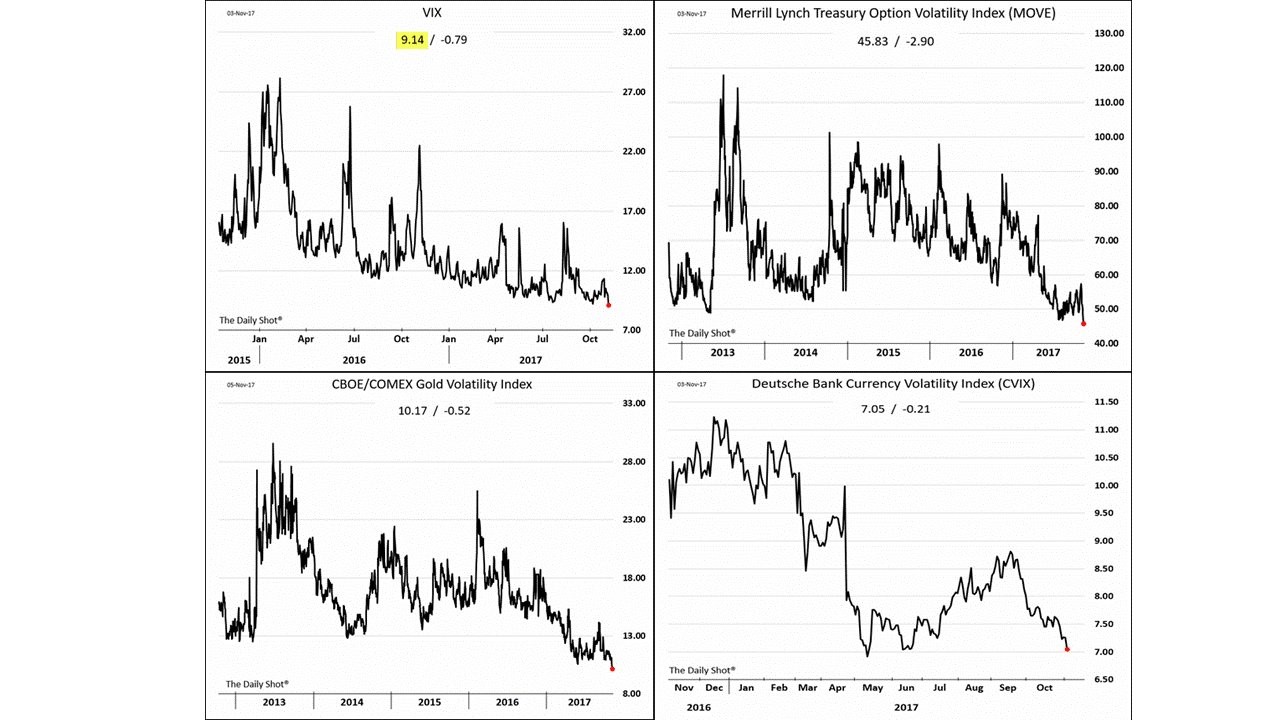

The stock market had a slightly negative day as the S&P 500 was down 0.02%. The Russell 2000 – RUT was a big laggard as it was down 1.26%. Ever since I warned about it being overextended, it has fallen. The VIX actually had a big up day which was weird since the stock action was so quiet. The VIX was up 5.64% to 9.93 as it remains below the 10 handle. The 4 charts below show the decline in volatility hasn’t been limited to stocks. The currency market, treasury market, and gold market are all seeing near multi-year declines in volatility. Uncertainty isn’t what it used to be. It seems like the market is embracing uncertainty instead of selling off when it occurs. This might be because the issues that are uncertain don’t hold as much weight as the issues previously. For example, the market is now concerned with who will get tax cuts instead of in the past when markets were concerned if Greece would leave the EU and if the entire currency bloc would break up.

Few Countries In Recession

The chart below provides support for this notion that uncertainty is about less important issues as the number of countries in a recession is expected to hit a record low in 2018. This isn’t a perfect indicator since the number of countries in a recession might not matter as much because the number could be swayed by only the small ones. However, the counterpoint to that is it would be almost impossible for only the big countries to be in a recession. This means when there’s a low amount of countries in a recession, the big ones are doing well. This chart shows how broad based the recovery has been as Brazil and China are having good years. India has experienced a slight slowdown which is expected to rebound in 2018. It is a bit disconcerting to see everything working so well. To me, it’s reminiscent of the roaring 1920s. Whenever everything is perfect, it doesn’t usually last long. The chart below goes a few years into the future. While I wouldn’t go as far as saying the 2018 projection is wrong, I think it’s unlikely the record will continually be broken the following 3 years. You can’t just draw a line and continue a trend forever. If that was the case, there would have been no housing burst and stocks would always go up about 8% per year. Don’t get complacent, as this won’t last forever.

Leave A Comment