Video Length: 0:00:42

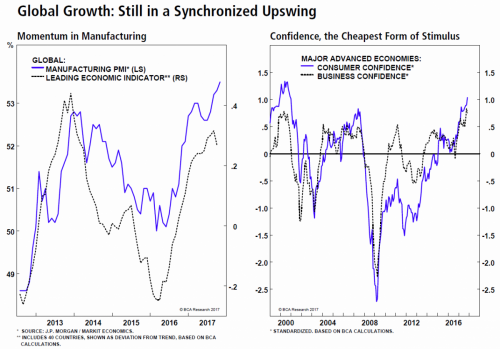

Global growth is still in a synchronized upswing and confidence by both consumers and businesses is the strongest it has been in years. Are investors headed for a big surprise in 2018?

Caroline Miller, BCA Research Global Stategist, believes there will be as the US economy sees better than expected growth starting next year. She recently spoke with FS Insider about BCA’s outlook, including both opportunities and risks for investors.

Global Synchronized Upswing Still Underway

Business is booming, and BCA’s data says that global growth is liable to remain firm heading into next year.

Though their 40-country leading economic indicator has moderated slightly from its 2017 highs, it is still pointing to above-trend growth.

Source: BCA Research – 2018 Global Macro Outlook

In terms of the composition of global growth, Caroline says to look for a possible rotation from Europe to the US in 2018.

“What’s likely to shift next year is that 2017 was definitely the year of the rebirth of Europe,” she said. “Our view at BCA is that, going into next year, we’ll see reasonably firm global growth, but a rotation back to the possibility of the US surprising to the upside.”

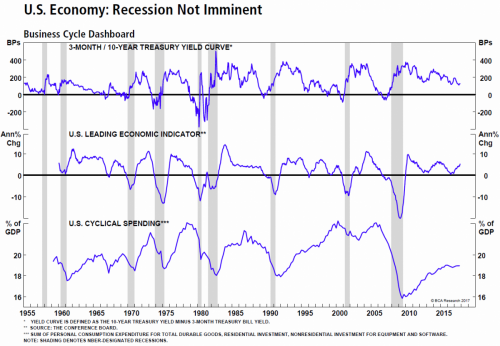

BCA’s Recession Outlook

Looking at a variety of leading indicators, Miller said the risk of an imminent recession in the US is quite low.

Three indicators in particular she cited as evidence are the Yield Curve, the Conference Board US Leading Economic Indicator, and US Cyclical Spending (see below).

Source: BCA Research – 2018 Global Macro Outlook

Given the data trends BCA is watching, Miller explained to listeners that the odds for a recession in the world’s largest economy are low for 2018 but that may change the following year.

Currently, their base case is for the US economy to “hit traffic leading to a recession later in 2019,” citing rising corporate leverage, wage pressures, and other factors.

Leave A Comment