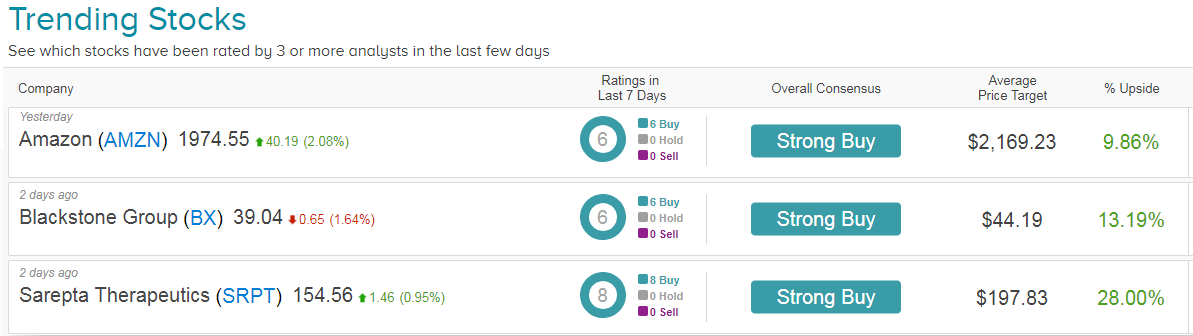

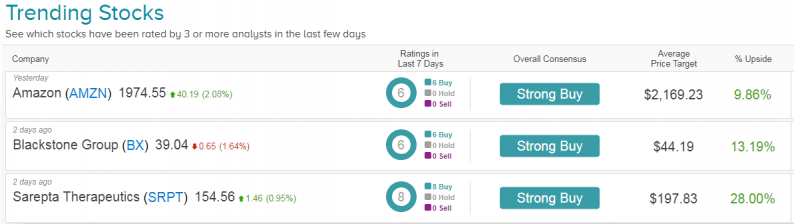

If you want to know which stocks analysts are getting excited about right now, turn to TipRanks’ Trending Stocks tool. Over the week, TipRanks’ algorithms have churned through all the Street’s latest ratings to reveal the best-rated stocks right now. Here we look at the results on a one-week basis but you can shift this to one month or even just 72 hours.

These three stocks clearly stand out as compelling picks right now. Check out the bullish ‘Strong Buy’ analyst consensus and the fact that each stock has received over 5 buy ratings in just 7 days. This is with no hold or sell ratings.

Let’s delve in and take a closer look at these three stocks now:

1. Amazon (AMZN)

Amazon has just hosted a special event in Seattle where it took to the stage for an unveiling that was described as “the largest number of devices and features that Amazon has ever launched in a day.” During the Amazon Devices Event, the company expanded its reach in the home and automobile with an onslaught of new innovations largely designed to ultimately make it easier to shop on Amazon.

Five-star Monness analyst Brian White (Track Record & Rating) described it as a ‘rainforest of new innovations.’ Prepare yourself for Alexa Guard which monitors your home and sends suspicious activity alerts, while Cook with Alexa helps out in the kitchen. Also upcoming: new Echo devices, Amazon smart home devices and Fire TV Recast (“a DVR that lets you watch and record live over-the-air TV at Home and on your mobile devices – All with no monthly fees”).

White reiterates a Buy rating on Amazon shares with a price target of $2,300 (16% upside potential), as “the company’s growth path is very attractive across the e-commerce segment, AWS, digital media, advertising, Alexa and more.”

Meanwhile, Jefferies’ Brent Thill (Track Record & Rating) ramped up his price target from $2,185 to $2,350 arguing that shares could surge to $3,000 by 2020. This would give AMZN a whopping $1.46 trillion in market value. He explains: “AWS, advertising, and subscription are all growing ~2 times faster than the core and are more profitable. We estimate conservatively these businesses will be on a combined $115B+ run rate by 2021.”

Leave A Comment