Companies Lose Billions On Stock Buybacks

I recently wrote an article about why “Benchmarking Your Portfolio Is A Losing Bet.” In that missive, I discussed all the things that benefit a mathematically calculated index versus what happens in an actual portfolio of securities. One of those issues was the impact of share buybacks:

“The reality is that stock buybacks are a tool used to artificially inflate bottom line earnings per share which, ultimately, drives share prices higher. As John Hussman recently noted:

The preferred object of debt-financed speculation, this time around, is the equity market. The recent level of stock margin debt is equivalent to 25% of all commercial and industrial loans in the U.S. banking system. Meanwhile, hundreds of billions more in low-quality covenant-lite debt have been issued in recent years.”

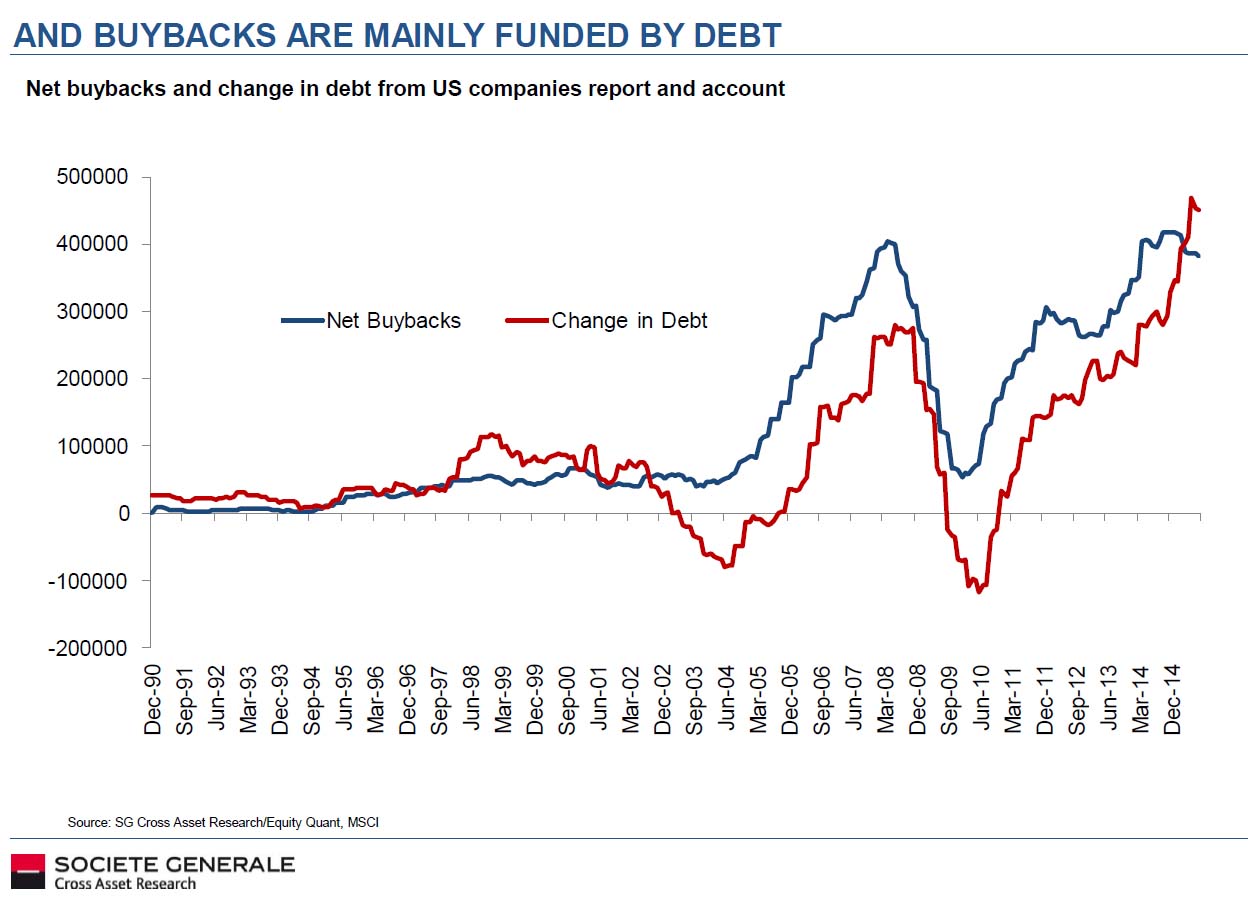

Note the surge in debt to fund those buybacks.

“The importance of buybacks cannot be overlooked. The dollar amount of sales, or top-line revenue, is extremely difficult to fudge or manipulate. However, bottom line earnings are regularly manipulated by accounting gimmickry, cost cutting, and share buybacks to enhance results in order to boost share prices and meet expectations. Stock buybacks DO NOT show faith in the company by the executives but rather a LACK of better ideas for which to use capital for.”

The entire article is worth a read to understand how indices and your portfolio are two very different things.

I bring this up because surges in stock buybacks are late bull market stage events. This is something I have repeatedly warned about in the past it is a false premise that companies repurchase stock at high prices because they have faith in their company. Such actions eventually lead to rather negative outcomes as capital is misallocated to non-productive resources.

Bernard Condon via AP picked up on this issue:

“When a company shells out money to buy its own shares, Wall Street usually cheers. The move makes the company’s profit per share look better, and many think buybacks have played a key role pushing stocks higher in the seven-year bull market.

But buybacks can also sap companies of cash that they could be using to grow for the future, no matter if the price of those shares rises or falls.

Defenders of buybacks say they are a smart use of cash when there are few other uses for it in a shaky global economy that makes it risky to expand. Unlike dividends, they don’t leave shareholders with a tax bill. Critics say they divert funds from research and development, training and hiring, and doing the kinds of things that grow the businesses in the long term.

Companies often buy at the wrong time, experts say, because it’s only after several years into an economic recovery that they have enough cash to feel comfortable spending big on buybacks. That is also when companies have made all the obvious moves to improve their business — slashing costs, using technology to become more efficient, expanding abroad — and are not sure what to do next to keep their stocks rising.

‘For the average company, it gets harder to increase earnings per share,’ says Fortuna’s Milano. ‘It leads them to do buybacks precisely when they should not be doing it.’

And, sure enough, buybacks approached record levels recently even as earnings for the S&P 500 dropped and stocks got more expensive. Companies spent $559 billion on their own shares in the 12 months through September, according to the latest report from S&P Dow Jones Indices, just below the peak in 2007 — the year before stocks began their deepest plunge since the Great Depression.”

Leave A Comment