Peddling Fiction

On Tuesday, as I watched the President’s State of the Union Address, the President made the following statement.

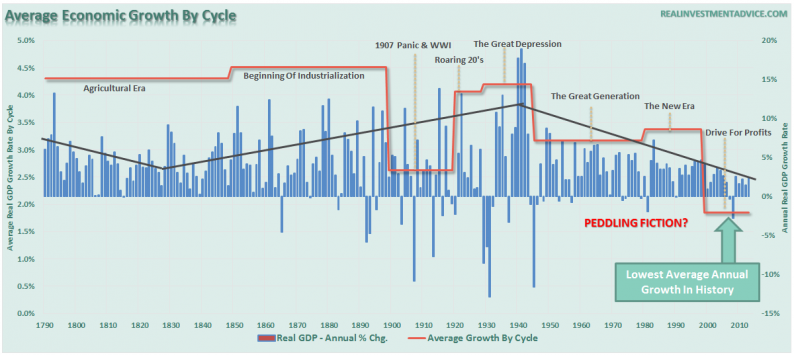

“Anyone claiming that America’s economy is in decline is peddling fiction.”

While I certainly understand the need to put a positive spin on the current economic backdrop during your last SOTU address, there is a good bit of misstatement in that comment.

The President is correct when he stated that the impact of technology on wage growth and jobs was not a recent development. It is, in fact, an impact that has been occurring since the 1980’s as shown in the chart below.

While the big driver of the decline in economic growth since the 1980’s has been a structural change from a manufacturing based economy (high multiplier effect) to a service based one (low multiplier effect), it has been exacerbated by the increase in household debt to offset the reduction in wage growth to maintain the standard of living. This is shown clearly in the chart below.

The problem for the President is that while sound-bytes of optimism certainly play well with the media, the average American is well aware of their current plight of the lack of wage growth, inability to save and rising costs of living.

The decline of economic growth is, unfortunately, a reality and an inevitable outcome of decades of deficit spending and debt accumulation. Can it be reversed? I honestly don’t know, but Japan has been trapped in this cycle for 30-years and has yet to find a solution.

Here’s Real Fiction – Low Oil Prices

Over the last couple of years, economists from Wall Street, to the Federal Reserve, to the White House have repeatedly made the following statement:

“Falling oil prices are great for the consumer as it gives them more money to spend.”

I have written many times over the past couple of years, as oil prices fell, that such was not actually the case. To wit:

Leave A Comment