Photo Credit: Bernard Goldbach

Amazon.com Inc. (AMZN) Consumer Discretionary – Internet & Catalog Retail | Reports February 1, After Market Closes.

Amazon ripped through the holiday season with initial reports stating it shipped 1 billion items worldwide through Prime and Fulfillment by Amazon. Amazon’s line of Alexa powered Echo devices stirred up the most growth in this period as sales of AI home assistants grew 9 fold from a year earlier. Even though retail is a core part of Amazon’s business, investors are more concerned with margin growth on Amazon Web Services. This part of the business generates much higher margins than retail and essentially led to profitability 4 quarters ago. In order for investors to come out of tonight’s report with a smile, web services must meet or exceed analyst’s expectation.

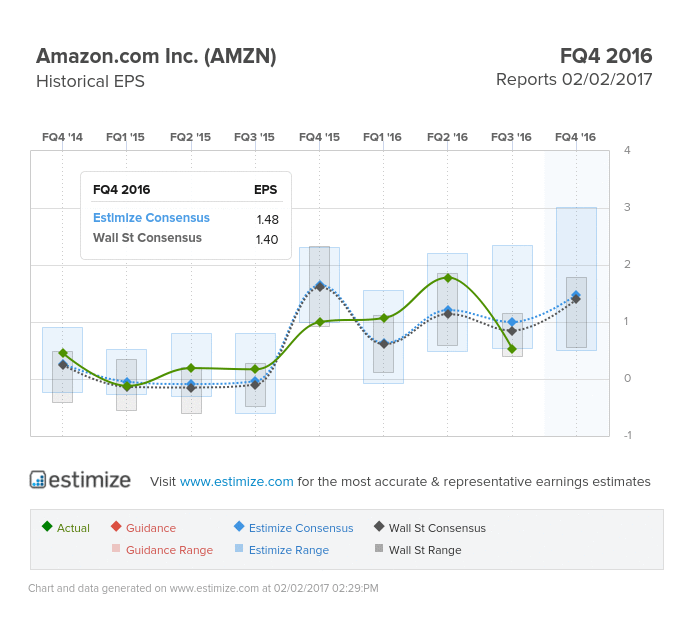

So far analysts at Estimize believe Amazon can deliver another strong report. The consensus data expects earnings of $1.48 per share, about 59% higher than the same period last year. That estimate declined by 30% in the past 3 months after a weak third quarter report. Revenue for the period is forecasted to rise 25% to an all time high of $44.95 billion. For Amazon, three factors play a major part in whether tomorrow’s print satisfies investors; Amazon Web Services, retail and other investments.

Amazon Web Services, as stated above, produces the highest margins across all of Amazon’s business. The segment remained solid in the third quarter despite a lackluster bottom line number. Business from AWS grew by about 55% to $3.23 billion and also generated record profits, with quarterly operating income income of $861 million. Amazon currently supports some of the biggest platforms like Netflix and Verizon and continues to add more features to further entrench itself as the de facto cloud computing service. That said, Microsoft’s recent rise in the space with Azure places some pressure on Amazon to expand and innovate so as to not lose any market share

Leave A Comment