A series of cyber attacks kept cybersecurity stocks rallying throughout the year. Earlier this year, two back-to-back ransomware attacks were reported — WannaCry or WannaCrypt in May and Petya in June — followed by the massive data breach at Equifax (EFX) in September. In addition to these, the data theft and ransom paid by Uber disclosed in November further fueled the bullish momentum of the stocks in this space.

Notably, the above-mentioned data breaches were a reality check, displaying how cyber attacks can escalate companies’ market and operational risks, and tarnish the brand image equally. Hence, the firms have now realized the immediate need for stricter security measures, which, we believe, will compel companies to further increase spending on cybersecurity.

Per a recently released report by Gartner, global enterprise security spending will reach $96.3 billion in 2018 — marking 8% growth from the 2017 expected level of $89 billion. Another market research firm, Markets, and Markets, in its July 2017 report stated that worldwide cybersecurity spending will likely reach $137.85 billion in 2017 and $231.94 billion by 2022.

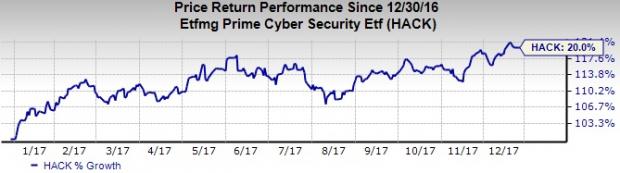

Encouragingly, cybersecurity companies will be the ultimate gainers in 2018 due to this elevated spending, similar to this year. It should be noted that the ETFMG Prime Cyber Security ETF (HACK – Free Report) has been up 20% in the year-to-date period, almost in line with the S&P 500’s gain of 20.2%.

Here, we have picked four stocks which have the potentials to make the most of this opportunity and make impressive share price momentum in 2018.

Moreover, these have a favorable combination of a solid Zacks Rank #1 (Strong Buy) and #2 (Buy), with a VGM Score of A or B. The VGM Score rates each stock on their combined weighted styles, helping to identify those with the most attractive value, best growth, and most promising momentum, across the board. Back-tested results show that this combination can handily beat other stocks.

Leave A Comment