It is a well-established fact that the widely-diversified transportation sector including airline companies, railroads, truckers, shippers to name a few, has struggled for the better part of 2017. Sector participants have been plagued by a number of headwinds like disruptions from back-to-back hurricanes, the devastating earthquake in Mexico, declining automotive volumes, issues related to customer dissatisfaction and high costs (labor as well as fuel).

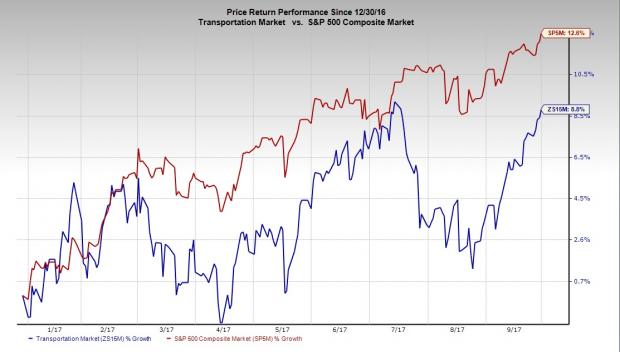

The lackluster performance of the sector in the first nine months of the year can be seen from the graph below. The chart clearly indicates that the sector has climbed only 8.8%, underperforming the S&P 500 Index, which appreciated 12.6% over the same period.

Uptrend Over the Last Few Months

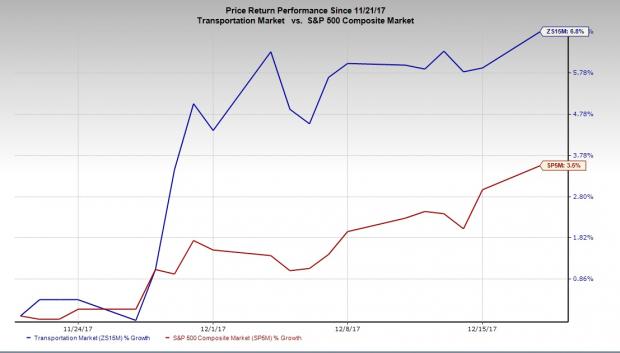

However, matters have been changing for the better over the past few months on the back of several tailwinds. We are optimistic about the fact that the sector has outperformed the S&P 500 index in a month. It has gained 6.8% compared with the S&P 500 index that advanced 3.5% over the same time frame.

Railroads Poised for a Great 2018

Railroads have been benefiting since the beginning of 2017 after struggling for the past couple of years. The prime factors contributing to this improved scenario are increased coal and intermodal revenues.

Particularly with Donald Trump’s presidency, the coal industry is seeing better days. The President is aiming to revive the industry by relaxing regulations, which were hurting its prospects.

The rise in natural gas prices is also favorable to boosting demand for coal. Moreover, per the U.S. Energy Information Administration (EIA), coal production in the United States will increase in 2018. Since revenues from coal contribute significantly to the railroads’ top line, any positive development for the commodity means good news for the sector.

Apart from coal, the scenario pertaining to another key source of revenues for railroads and intermodal, has improved by leaps and bounds this year. In fact, intermodal shipments are expected to grow 4.2% in 2018. This in turn will drive the top line for railroads.

Moreover, railroads like Union Pacific Corp. (UNP – Free Report) have hiked their quarterly dividend payouts this year, indicating their financial prosperity. The solid financial status of these companies bodes well for 2018.

Recovery of the U.S. economy is also likely to pave the way for railroads. Notably, U.S. GDP is expected to increase by 2.4% in 2018, higher than what was achieved in the last two years. Generally, a buoyant domestic economy results in an uptick in rail shipments of goods across the United States.

The improved economic scenario is evident from the fact that in the third quarter of 2017, the domestic economy expanded at an impressive annual rate of 3%, per the latest report from the Commerce Department. The reading was above the consensus estimate of 2.6%.

Leave A Comment