Markets have struggled to find any sort of clear direction in February after posting deep losses to begin 2016. A recent rebound in crude has helped the market stabilize over the past two weeks. However, myriad worries continue to spike volatility as investors veer back and forth between pessimism and cautious optimism.

Global growth concerns remain center stage as the G20 sounded increasingly desperate calling for coordinated efforts to boost worldwide demand before an upcoming summit. Although the major stock indices seem to have found a temporary floor in recent sessions, many areas of the market are deep in bear markets. Biotech, small caps, emerging markets, energy, and commodities are all in official bear markets, some of which are severe.

As investors and pundits agonize on what the next move of the Federal Reserve might or should be and whether a global recession can be avoided, I think the most prudent use right now for any “dry powder” on subsequent dips in equities is to buy cheap stocks with generous dividend yields. The high payouts should help to put a floor under significant declines, and right now I am finding good bargains in the market to snatch up.

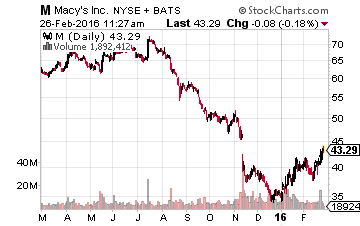

Retailer Macy’s (NYSE: M) is one of the select group of stocks that has had a very solid 2016. This comes after a quite dismal 2015 for investors, however. The shares definitely feel like they have put in a bottom. The department store chain posted a very well-received quarterly earnings report last week easily beating both top and bottom line estimates.

The company also noted that it is seeing “strong interest” as it begins to contact parties regarding real estate deals. Stifel Nicolaus recently stated it could see some significant one-time gains from real estate transactions that will provide a boost to the share price in 2016. Some activists have publicly pushed the company to pursue this direction for some time given their belief that the company’s real estate holdings alone might be worth more than the market capitalization of the stock. Its Herald Square location that sits on one full city block in Manhattan could be worth $3 billion to $5 billion by itself. Regardless, the shares are still cheap at 10.5 times earnings with a 3.6% dividend yield.

Leave A Comment