There has been a lot of whining among investors that there are no values in the stock market anymore.

Most of the big cap, well known names, appear to be overvalued with forward P/Es of the glamour stocks, such as Amazon and Facebook, of well over 25x.

But that just means investors don’t know where to look.

Large cap growth stocks have been “in” for the last 2 years. Meanwhile, the small cap companies have been ignored by Wall Street during that time period.

The large caps are now considered by most to be fairly valued or, actually, slightly on the expensive side as the S&P 500 trades with a forward P/E of 18.

The small cap index, the Russell 2000, however, is trading with a lower valuation, with a forward P/E of 17.3.

And if you drill down into the value component of the Russell, it is even cheaper.

The Vanguard Small Cap Value Index (VBR), which is designed to track the CRSP US Small Cap Value Index, has a trailing P/E of 16 as of Apr 30, 2016.

If you’re looking for value, small caps are the place to be.

What About Performance?

The large cap stocks have outperformed the last two years, but over longer time periods, the small caps, and in particular, small cap value stocks, have tended to have the top performance.

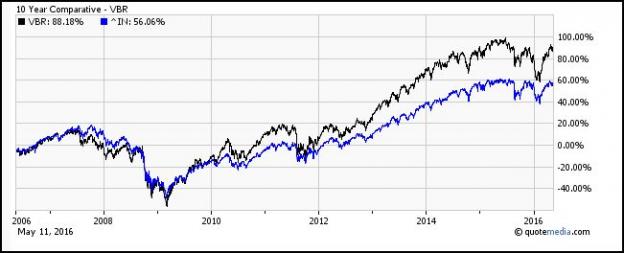

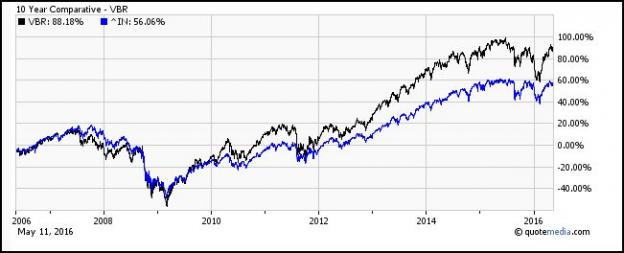

In a comparison over the last 10 years, the Vanguard Small Cap Value ETF (VBR) easily beats the performance of the S&P 500 with a return of 88% versus the S&P 500’s 56%.

But what about dividends?

Most investors believe that the large caps pay high dividends and the small caps pay next to nothing so they stick with the large caps.

But the trailing dividend yield of the SPDR S&P 500 ETF (SPY) is 2.1% as of Apr 30, 2016 while the trailing dividend yield of the Vanguard Small Cap ETF is 2.17%.

There’s really no excuse to avoid the small cap value stocks.

5 Top Small Cap Value Stocks

If you want to buy individual value stocks, and not the indexes, there are a lot of names that are attractive.

Leave A Comment