Fourth-quarter 2015 was more or less a replica of the preceding three quarters. Plunging crude prices during the entire quarter hammered the market and led many energy players to follow the bearish trend. Although none of the energy companies have released their fourth-quarter earnings results as of Jan 13, 2016, investors might still be thinking of excluding energy stocks from their portfolio following the persistent weakness in commodity prices.

Our study here will point to those stocks that are benefiting from low crude prices. In fact, these companies also have a high probability to beating our estimates as they need low pricing to boost their earnings.

Fourth-Quarter Oil

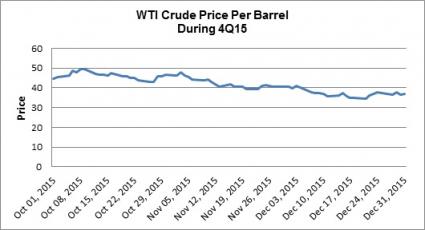

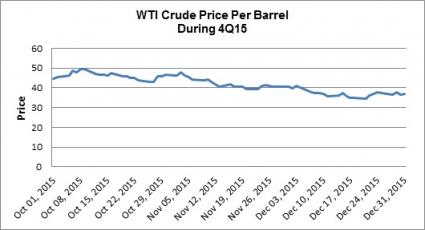

The West Texas Intermediate (WTI) crude traded much below $50 per barrel during the entire fourth quarter, thanks to the plentiful supply of the commodity amid lackluster global demand. In fact, crude even got a bitter taste of the below-$40-a-barrel mark in Dec 2015 after the Organization of the Petroleum Exporting Countries (OPEC) decided not to cut production at its Vienna meeting on Dec 4.

Investors should note that in reality, a war for market share has been raging among the likes of OPEC, the U.S. and Russia. Each of these markets has been pumping hard and competing for market share, completely ignoring the downtrend in oil price.

Below we show the price of WTI crude per barrel during the fourth quarter. The data is compiled by The Energy Information Administration (EIA) – which provides official energy statistics from the U.S. government.

Gainers

Low crude is a positive for those energy players involved in midstream activity, especially the refiners. This is because refiners buy raw crude from the exploration and production companies to produce refined petroleum products like gasoline. Hence, as in the prior quarters, the refiners have been benefitting from the low operating costs.

On top of that, excess supply calls for huge storage and transportation activities. As a result, companies involved in those activities are also expected to see overall gains. Likewise, the downstream firms are also expected to buy refined petroleum products at much lower prices in a bearish crude market.

Leave A Comment