Wednesday, December 2

Thursday, December 3

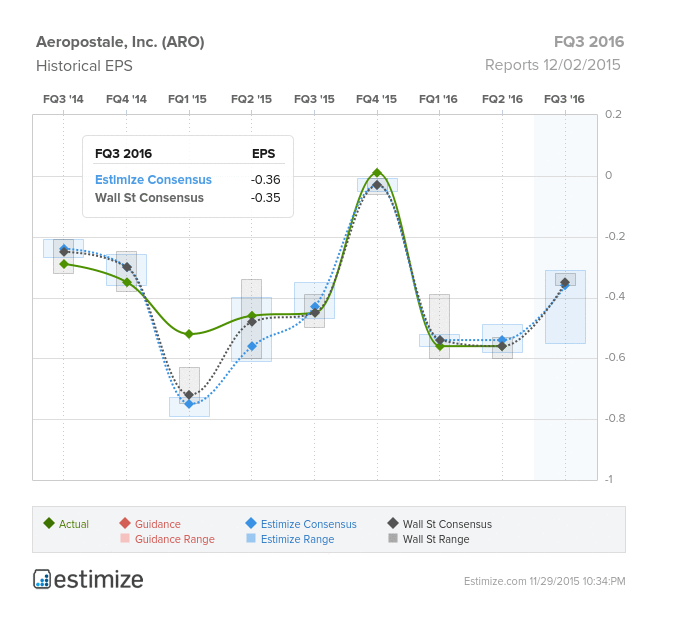

Aeropostale, Inc. (ARO)

Consumer Discretionary – Specialty Retail | Reports December 2, after the close.

The Estimize consensus calls for EPS of -$0.36, a penny worse than the Wall Street consensus. Currently, the Estimize community is looking for sales of $388.98M, a mere $420k higher than the Street’s expectation.

What to Watch: Last week, Abercrombie & Fitch kicked off the teen retail reports with a bang. The company posted FQ4 2016 EPS of $0.48, 28 cents above the Estimize consensus. Revenues also beat expectations by $11.4M. This was a welcomed report as teen retailers have continued to lose market share to the “fast fashion” names such as H&M, Zara and Forever 21. Aeropostale is on the lower-end of the teen retailers, catering to more value-conscious shoppers. The company missed estimates for the first two fiscal quarters of 2016, and are expected to post their third consecutive quarter of negative EPS in FQ3 2016. Same store sales have also been a weak spot, falling 8% in the latest quarter. As such, the company provided Q3 EPS guidance in a range of -$0.30 to -$0.38, and operating losses of $19M – $25M. CEO, Julian Geiger did say he was pleased with results from the beginning of the back-to-school shopping season, boosted by a particular improvement in girls’ apparel. We’ll hear on Wednesday if that trend continued throughout the rest of the quarter, and more on the company’s outlook for the all important holiday shopping season.

The Kroger Co. (KR)

Consumer Staples – Food & Staples Retailing | Reports December 3, before the open.

The Estimize consensus calls for EPS of $0.41, 2 cents below the Wall Street estimate. Revenues of $25.27B are above the Street’s expectation for $25.22B.

What to watch for: Kroger has been intently focused on expanding their natural and organic food business and as a result has been able to steal market share from upscale grocers. The mainstream grocery chain provides value offerings to customers that are no longer willing to spend their whole paycheck at Whole Foods. The company has shown strong fundamentals, with earnings per share (EPS) growth in the double digits for the past six quarters, and double-digit sales growth in four of the past six quarters. Kroger faces some stiff competition from other retailers enforcing the same strategy such as Wal-Mart, Target and Sprouts. The stock is up 18% this year.

Leave A Comment